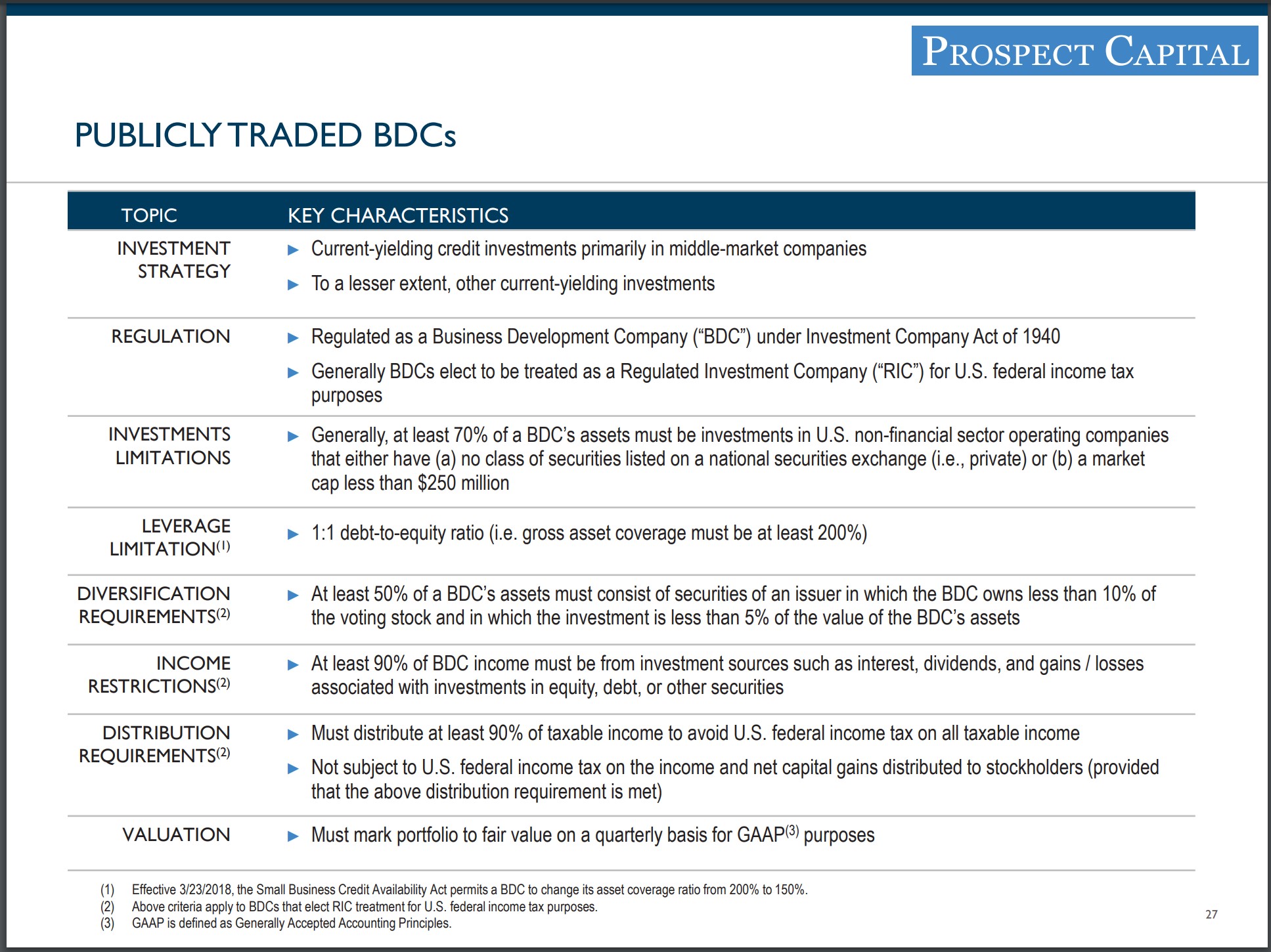

Business Development Companies, or BDCs, are often considered by dividend investors as a result of their quite sizable dividend yields, as compared to the overall market. In this piece, let’s take a look at how these companies operate and then also compare some important metrics between the various players. First, let’s looks at the below slide from Prospect Capital, which highlights some important differentiating features of BDCs.

Image Source: Prospect Capital Investor Presentation

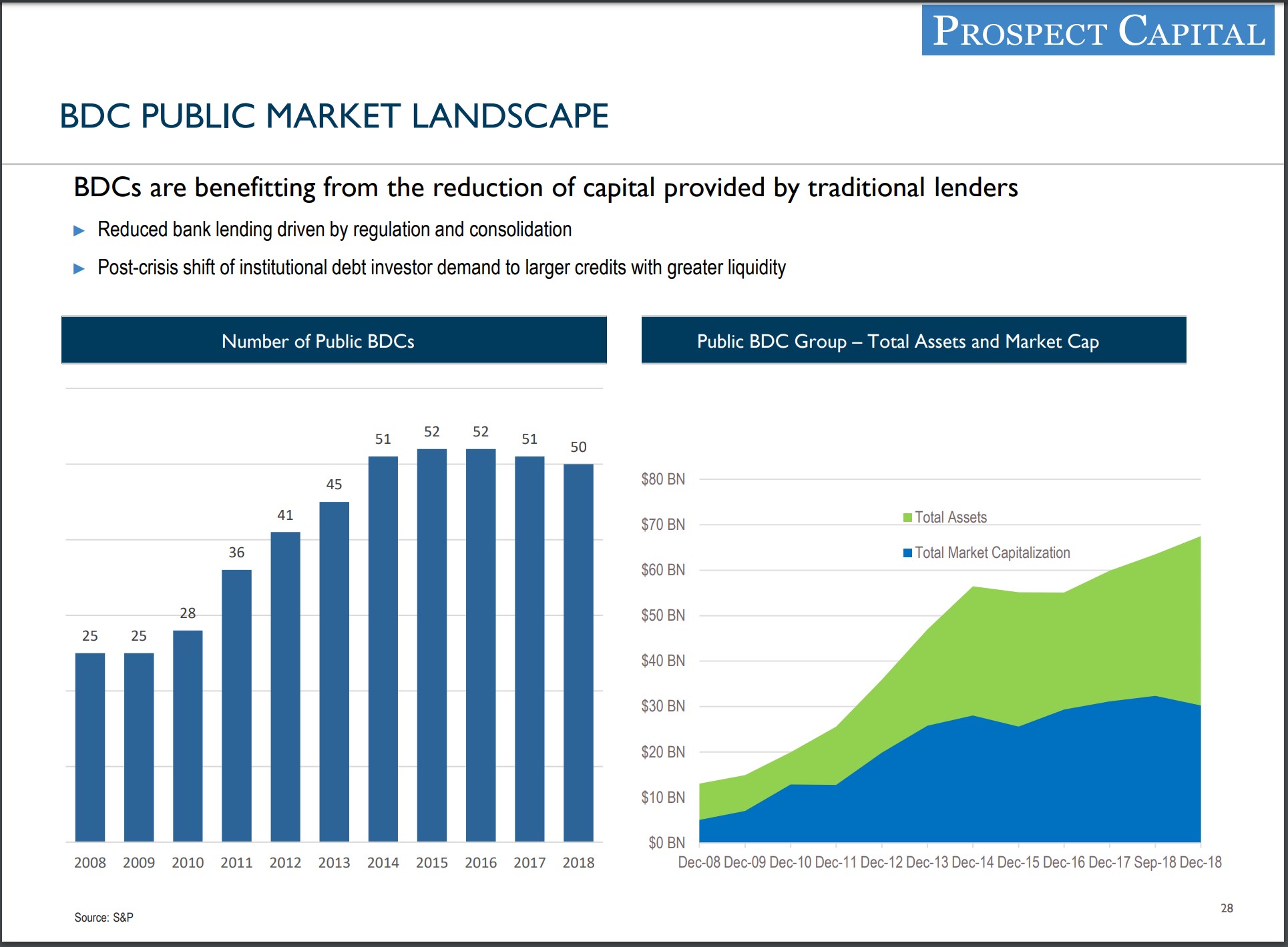

Importantly, please know that you will need to consult a tax professional to determine how to treat the various dividend and return of capital from BDCs. Let’s also look at the below graphic from Prospect Capital (PSEC), which highlights the growth in BDCs over the past 10 years of mostly benign economic conditions.

Image Source: Prospect Capital Investor Presentation

So, what exactly are BDCs? Business Development Companies are closed end investment vehicles that invest primarily in loans primarily to middle market companies. When you look at the asset side (left hand side) of the balance sheet, you will see first lien loans primarily for most of the BDCs, but you will also see second and subordinated debt in some portfolios. You will sometimes see preferred stock, structured debt, and quite often you will see equity investments that are paired with debt capital provided to the portfolio companies. When all goes to plan, the equity holdings serve as an upside kicker as the portfolio company successfully deleverages or otherwise gains in value. These gains are important in that they also can help offset credit losses on other portfolio holdings that go wrong.

Essentially, it is my view that BDCs are a bit like banks on steroids. Since they don’t have deposits, the right-hand side of the balance sheet is comprised of bank lines of credit, subsidized SBA loans, bonds, and equity capital. Historically, BDCs have been leveraged one time, but that rule was just recently relaxed to allow BDCs to now be leveraged up to two times. In fact, many of the BDCs we looked at are in the process of going lower risk on the asset side of the balance sheet by holding more first lien loans and they are making the case to increase leverage as per the new rules. Increased leverage could easily equate to increased risk, so this is something to watch as the industry landscape is currently undergoing an experiment in increased leverage.

BDCs: Banks on Steroids

Back to the characterization of BDCs as banks on steroids. While banks have very low cost of funds due to low cost deposits, Business Development Companies average cost of borrowing looks like it is in the 5-and-change percent range – MUCH higher than that of banks. They also earn MUCH more on their liabilities than banks do. The weighted average yield on BDC portfolios is most typically in the range of 10-and-change percent. So how do you get such a juicy yield lending to what are usually claimed to be high quality portfolio companies. The answer is that the vast bulk of the capital lent by BDCs is for the purpose of management or leveraged buyouts or recapitalization of the balance sheet (swapping in debt to pay out special dividends on equity.)

In fact, most deals are sourced through Private Equity sponsors or Wall Street firms, while others result from a more direct relationship with the companies. Quite often, the portfolio companies are lent to over and over again. So, one can picture, that they are levered up to be bought out or to pay out to existing shareholders. The companies then hope to successfully deleverage their balance sheet, only to go through the same process all over again. This is a way for owners of middle market companies to strip equity value out of a company up front and then hope for the best as the company must then negotiate the economic and competitive landscape while carrying leverage which is usually in the ballpark of 5 and change times Debt/EBITDA and with EBITDA interest coverage of only 2 and change times.

What does this mean in terms of risk and reward? Let’s just say that for those that choose to invest in a BDC for their high yields, significant fear and stress will enter the equation if a severe recession or depression were to come along. One can picture the revenue of the portfolio companies broadly declining in such a severe economic environment. With operating leverage, the income and cash flow hits are typically amplified. Interest coverage would drop and some portfolio companies would face debt distress. The equity holdings would be dented and wiped out first and then comes restructuring or bankruptcy. More junior debt positions could easily be wiped out and senior loans might be restructured into lower value instruments or even converted into equity in the restructured company.

Fear of these things coming to pass had BDC shares absolutely tanking during the Global Financial Crisis (GFC). The Federal Reserve obviously took rates down to zero, which along with other rescue efforts by the Treasury and Congress in the form of TARP bank recapitalizations, helped prevent the worst from actually coming to pass. Nonetheless, it took years for many BDC shares to recover to pre-crisis levels, and some never did recapture those previous lofty levels. In fact, I would state rather simply that owning Business Development Company shares carries an implicit bet against a depression from happening ever again. Buyer beware.

What Are Some BDCs to Consider?

With that key risk laid bare, what are the characteristics of the soundest Business Development Companies? The best BDCs are well run with seasoned teams of leaders, deal originators, underwriters, legal, accounting, tax, and compliance. The best teams know how to identify a high-quality company that can handle such enormous debt loads through most environments that could occur. They study the management team, competitive advantages, and study the fundamental risks the portfolio company faces. They lead deals instead of simply participating in syndicated deals.

They set the terms of the loan along with the portfolio company and any sponsors. They know how to judge risk versus reward when investing. They take sizable equity stakes in portfolio companies alongside the loans. They assist the portfolio companies much like a private equity sponsor would do, and actually help to make portfolio companies better and stronger. The portfolios of the best BDCs are extremely diversified so that no one portfolio company gone wrong can dent the earnings and dividend power of the BDC itself.

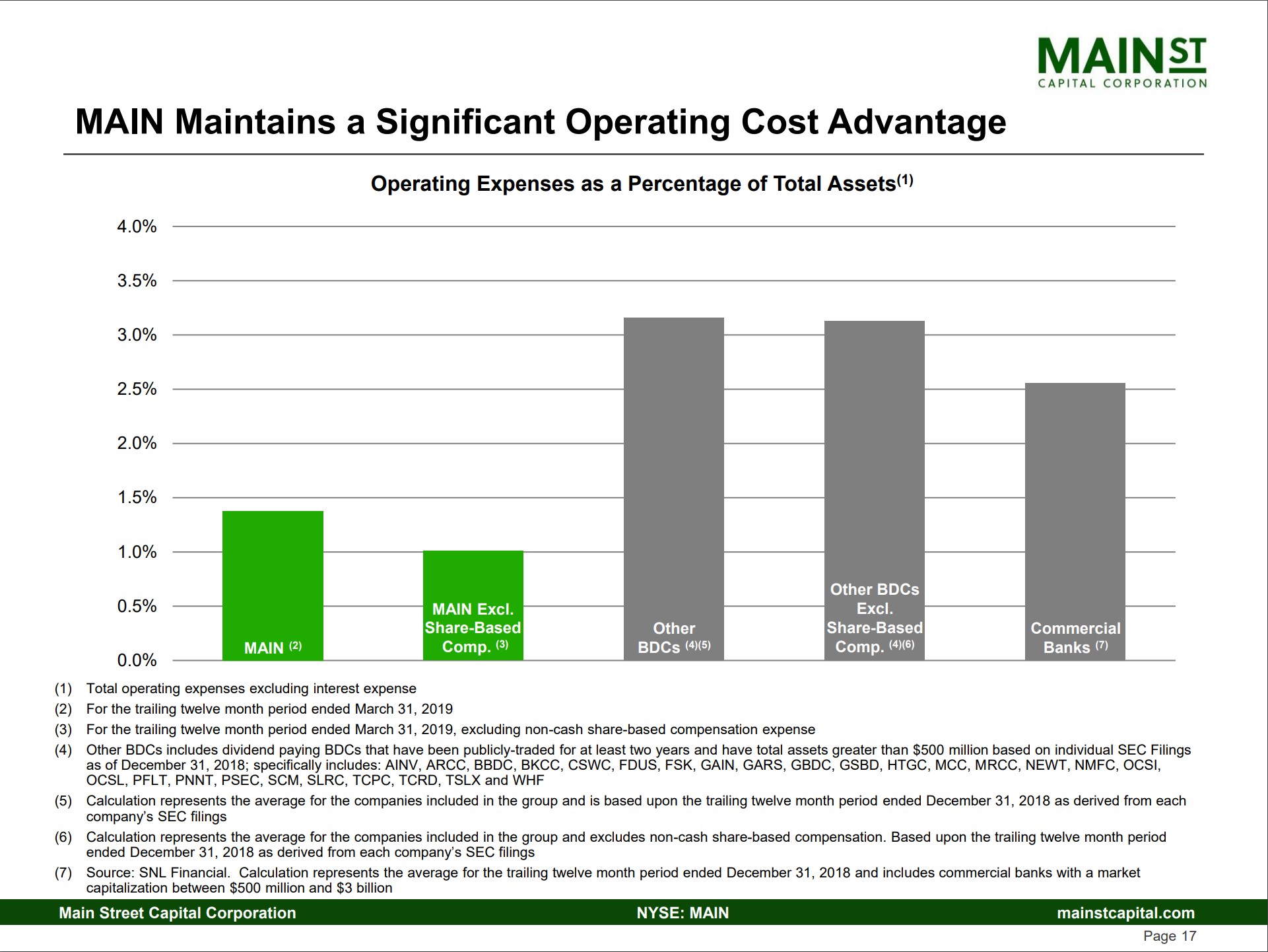

If I were to pick one Business Development Company to highlight, it would be Main Street Capital (MAIN). Let’s go through some of the most important metrics below to see why they bubble up to the top in terms of BDC quality. First off, you can see below that MAIN operates with a lean operating expense structure. Just as with a bank, this is important in terms of translating revenues into earnings and dividends.

Image Source: Main Street Capital Investor Presentation

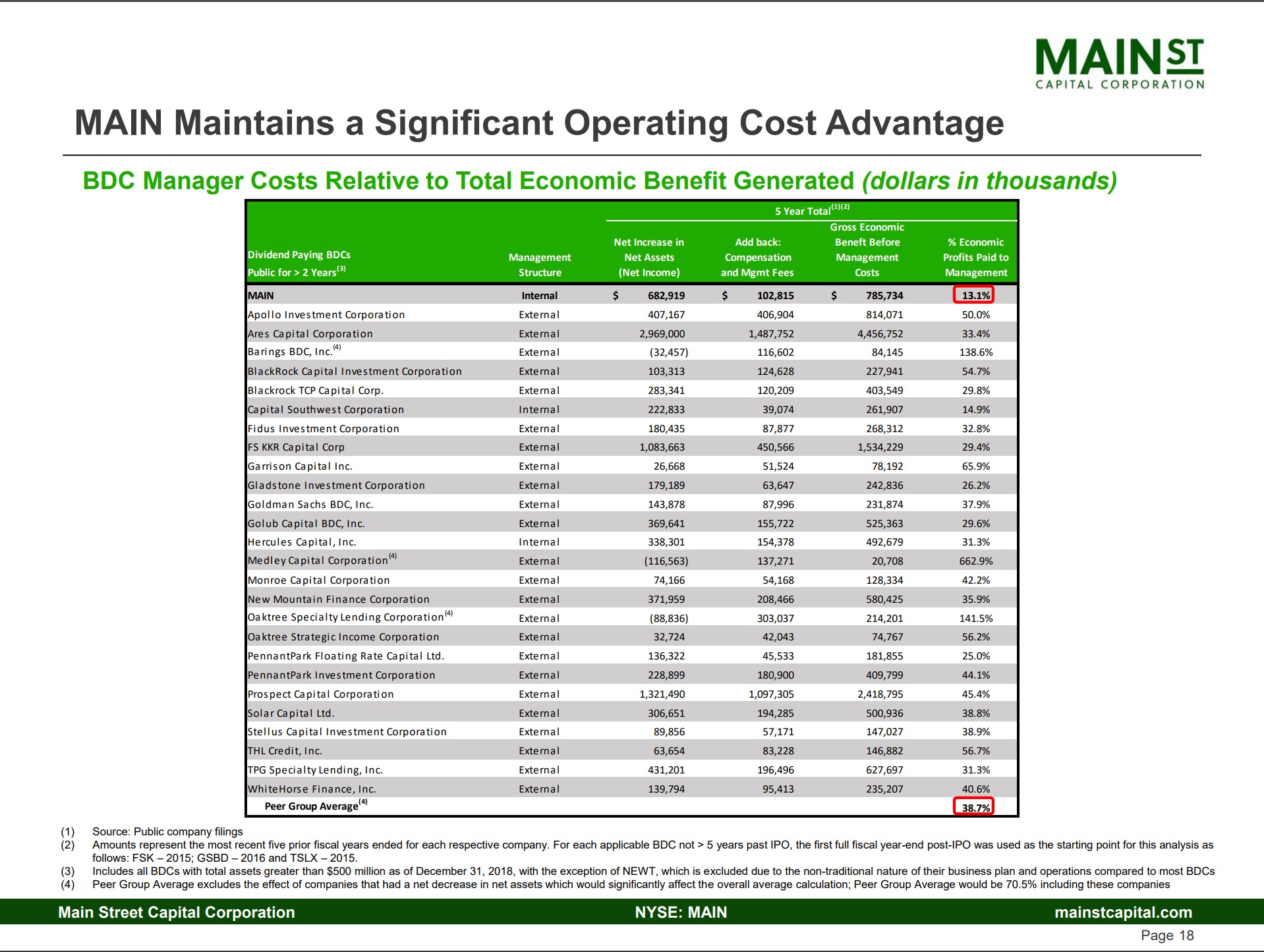

As you can see below, MAIN’s percent of economic profits paid to management is significantly lower than most of its peers. You can also see in the below graphic that the management teams of some BDCs are really hoarding much of the value creation they are able to generate!

Image Source: Main Street Capital Investor Presentation

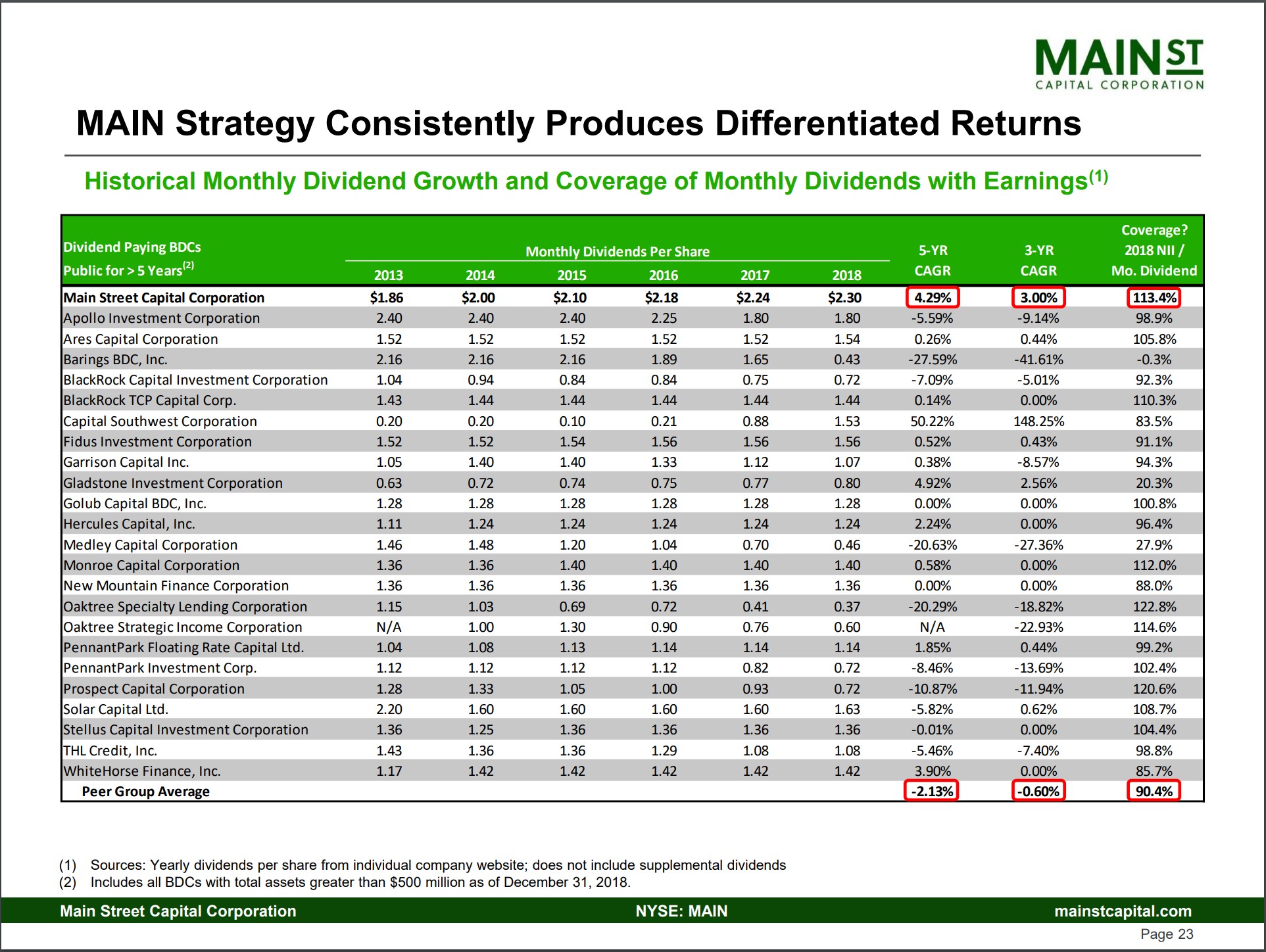

You can also see in the below graphic that Main Street Capital has been able to grow its dividend stream better than most of its peers. The dividends are also covered by Net Investment Income, speaking to the sustainability of the payout.

Image Source: Main Street Capital Investor Presentation

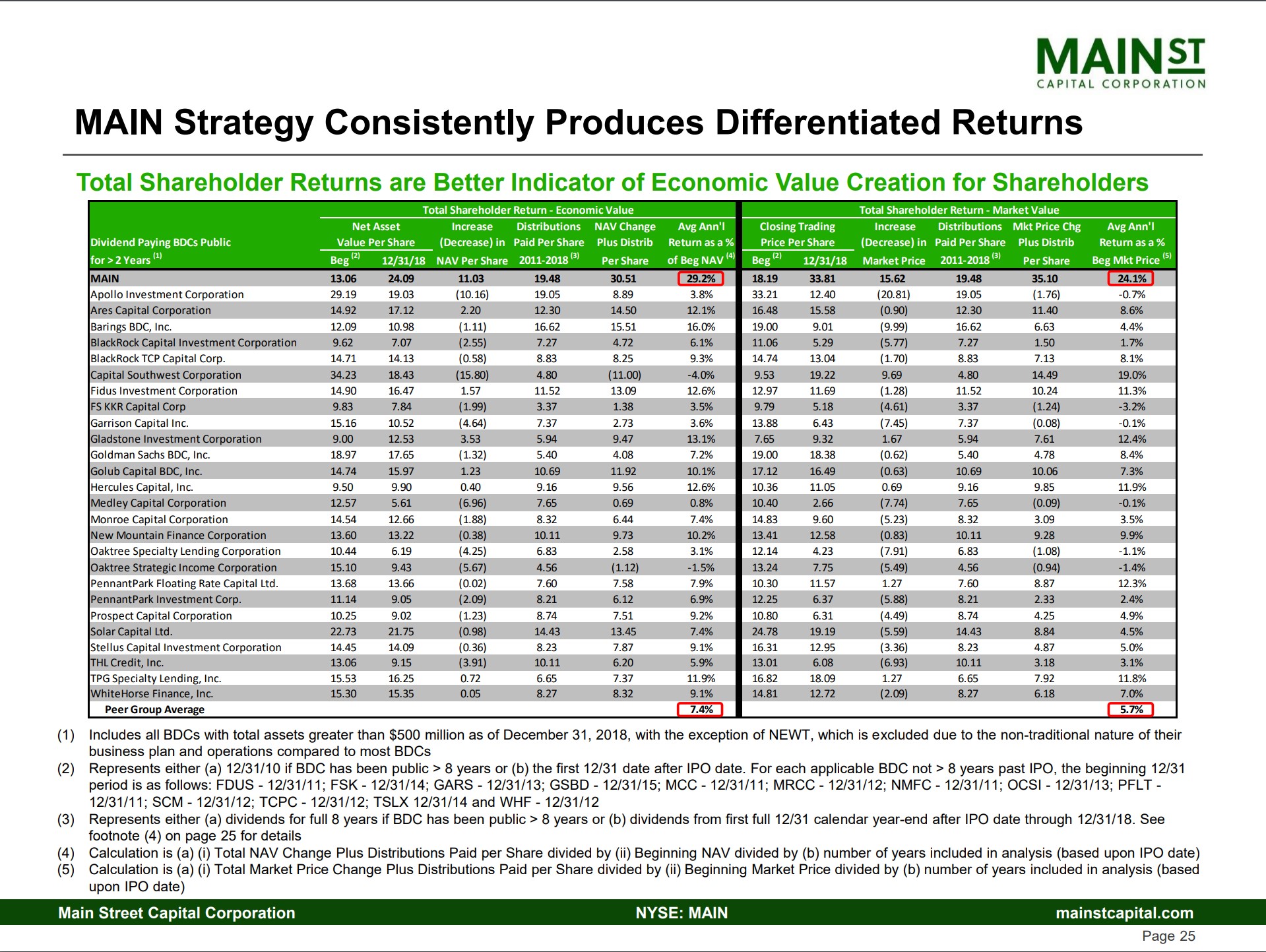

Below, you can see that Main Street outperforms most of its peers in total return whether looking at NAV/share change plus dividends or total share price return plus dividends. These higher than peer returns reflect the quality of Main Street. This quality is also reflected by the fact that MAIN trades at a higher premium to NAV and lower dividend yield than most of its peers. Main Street’s superior performance has not gone unrecognized by the market. One benefit of this is that the BDC can issue shares at a premium to NAV when it needs the capital to grow.

Image Source: Main Street Capital Investor Presentation

The below graphic shows that while Main Street has in fact issued equity (at a premium) in order to grow, those efforts have been rewarded by the market. Hence, the capital has been put to good use in the portfolio, and it has been reflected in the share price.

Image Source: Main Street Capital Investor Presentation

Perhaps the most important metric for a BDC is the return on equity, which you can see below. Main Street has been consistently better than most of its peers on this front. Many peers are putting up abysmal ROEs in fact.

Image Source: Main Street Capital Investor Presentation

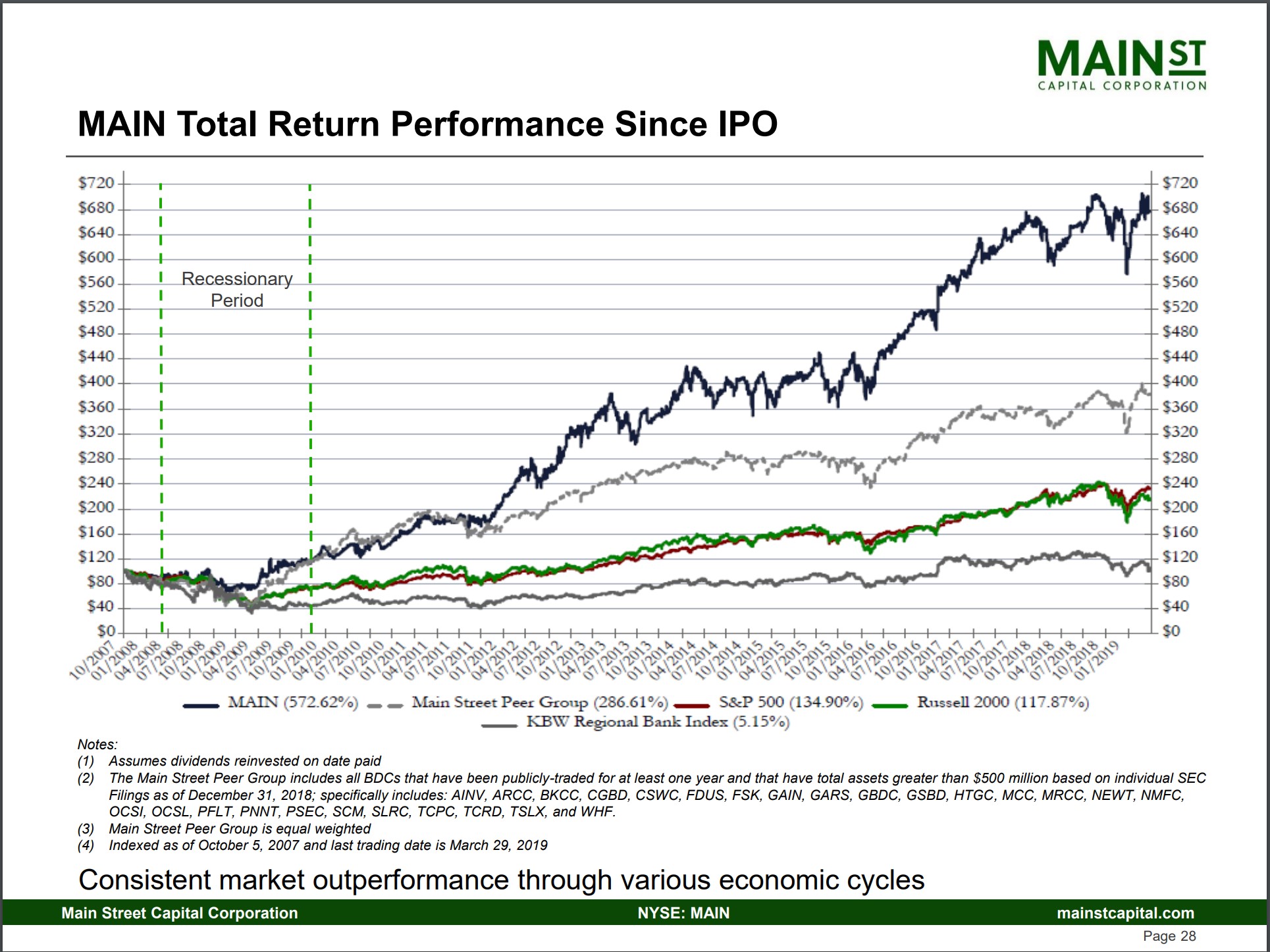

And finally, let’s look at the share price scoreboard. Bear in mind that the below graphic assumes all dividends are reinvested, which is not what a typical BDC income-oriented investor would do in practice. Nevertheless, you can see Main Street’s outperformance against its BDC peer group and the broader market indices.

Image Source: Main Street Capital Investor Presentation

Concluding Thoughts

Despite the many positive comments on Main Street Capital, please don’t forget where we started. BDCs really are like banks on steroids. If a very severe recession or outright depression were to come along, the leverage employed by BDC portfolio companies could simply be too much to bear if revenues were to decline more than what would be expected in a “normal” economic environment. BDC shareholders simply own this risk, which can be quite uncomfortable when things go south.

Related BDCs: ARCC, AINV, GAIN, NEWT, PNNT, TCPC, GSBD

Related ETFs: BDCL, BDCS, BIZD, FGB, LBDC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.