Strong outlooks for Kimberly-Clark, United Technologies, Hexcel and Lockheed Martin point to an economy that is still gaining momentum. We caution investors of consumer staples stocks, however, with many equities holding large net debt positions, and the sector trading at almost 20 times forward earnings. Learn about the difference between the Best Ideas Newsletter portfolio and the Exclusive publication and much more in this note.

Image Source: Alan Levine

—

By Brian Nelson, CFA

Welcome new members!

As you’re getting familiar with the website, please watch the Navigation Video. For those passionate about financial analysis and to see how deep our team goes with our research, please watch the Financial Analysis Video. Finally, don’t forget to flip through the , and read our team’s first book in finance, Value Trap: Theory of Universal Valuation. We’re always available for questions, so feel free to ask away.

That said, the bull market is still going strong, and almost nothing seems to be able to get in its way. Whenever a threat seems to emerge on the horizon, the Fed is ready to act, almost as if we’re amid a great financial crisis, reminiscent of the one late last decade. Given how edgy the Fed is, it’s hard to believe how good things are — the US has the strongest economy it has ever had, unemployment is at decade lows, inflation is tame, borrowing costs are low, energy resource prices aren’t egregious, and most of the world remains at peace, despite deteriorating US relations with Iran. Things really could not be better. Even gold (GLD) prices are showing signs of life.

Second-quarter earnings season is going well, too. Consumer bellwether Coca-Cola (KO) reported solid second-quarter results July 23 that showed non-GAAP organic revenue advancing 6% and comparable earnings per share up 4%, overcoming stiff currency headwinds. Year-to-date free cash flow came in at $3.7 billion, up considerably on a year-over-year basis. We like Coca-Cola’s move into the energy drink space, as well as its hefty stake in Monster Energy (MNST), but the market is way too aggressive with the company’s valuation. The stock is trading for 25 forward earnings as it holds a sizable long-term debt position. Shares are overpriced, in our view. Coca Cola’s stock page >>

The drum beat of upwardly-revised guidance during this earnings season has been steady thus far. For starters, Kimberly-Clark (KMB) posted decent second-quarter performance July 23 that showed organic sales increasing 5%, while adjusted diluted net income came in at $1.40 per share in the period, up from $1.30 in last year’s quarter. The results were good enough for Kimberly-Clark to raise its 2019 earnings guidance to the range of $6.65-$6.80, up from the range of $6.50-$6.70. At the high end of the guidance range, Kimberly-Clark is trading at nearly 20 times earnings, however, and like Coca-Cola, it holds a sizable net debt position. Shares of Kimberly-Clark are not cheap either. Kimberly-Clark’s stock page >>

—

Image: Consumer staples equities come with fantastic business models, but shares of the group are trading at lofty earnings multiples and often come with hefty net debt positions. Consumer staples equities have substantially underperformed the market since early August 2016.

In early August 2016, I made a reference to how consumer staples equities (XLP) were trading like it was the Roaring 20s. I also talked about the topic on my trip to the CFA Society Houston in March 2017 — presentation (pdf). Since early August 2016, the broader stock market, as measured by the S&P 500 (SPY) has advanced nearly 38% while consumer staples equities have advanced a modest 10%. That’s a large degree of underperformance by consumer staples names since that call, and according to FactSet, the consumer staples sector is still trading at almost 20 times 12-month forward earnings. We think returns across some of the strongest business models will remain subdued, as they have been.

The performance of REITs (VNQ) and MLPs (AMLP) relative to the S&P 500 hasn’t been that great since the middle of this decade either, so many dividend and income investors haven’t been catching the strongest of the waves of this near-decade long bull market. We reiterate that investors should always focus on intrinsic values, as we believe this focus will help inform readers of a better estimate of total return than just the dividend yield alone. As many dividend investors have witnessed the past few years, other investors have bid dividend payers to new heights, making for subpar returns the past several years. Pay attention to intrinsic value estimates! I cannot say it enough.

There was good news that hit the wire across the industrials (XLI) space. United Technologies (UTX) issued a better-than-expected second-quarter report July 23 that showed organic growth of 6% and adjusted earnings per share expanding 12% over the same quarter last year. The firm noted that the integration of Rockwell Collins is going well (aftermarket sales were up considerably) — so well that the executive team raised its 2019 outlook, now targeting organic sales growth in the range of 4%-5% (was 3%-5%) and adjusted earnings per share in the range of $7.90-$8.05 (was $7.80-$8.00). United Technologies is also on track to establish Otis and Carrier as independent entities, scheduled for the first half of 2020. Shares of United Technologies are trading within our fair value estimate range at the time of this writing. United Technologies stock page >>

Despite Boeing’s (BA) troubles with the 737 MAX, aerospace remains a very strong end market. For those that know Valuentum, we have liked aerospace for a very long time. Aerospace and defense suppler and maker of carbon fiber reinforcements and resin systems Hexcel (HXL) reported strong second-quarter results July 22, with sales advancing 11%+ and adjusted diluted earnings per share increasing 35% on a year-over-year basis, to $0.94 per share. The firm noted softer demand related to 737 MAX production, which was expected, but it also pointed to strength across other Boeing and Airbus (EADSY) platforms, as well as growth in the F-35 Joint Strike Fighter. Hexcel raised its 2019 earnings per share guidance to the range of $3.43-$3.53 per share (was $3.38-$3.52 per share), and we like the momentum. Hexcel’s stock page >>

Lockheed Martin (LMT) reported second-quarter results July 23 that revealed strong expansion in net sales (up 7.5%) and a solid increase (23.4%) in net earnings per share. Management noted strength across all four of its business lines, pointed to a record-high level of backlog, and raised its outlook for 2019. Net sales for the year are expected at $59.75 billion at the high end of its target range (was $58.25 billion), while diluted earnings per share is targeted at $21.15 per share at the high end of the annual targeted range (was $20.35 per share). Lockheed is one of our favorite defense contractors, but its shares come with a hefty price tag, too. Geopolitical tensions from North Korea to Iran to Russia may mean Lockheed garners the market’s favor for some time, however. Lockheed Martin’s stock page >>

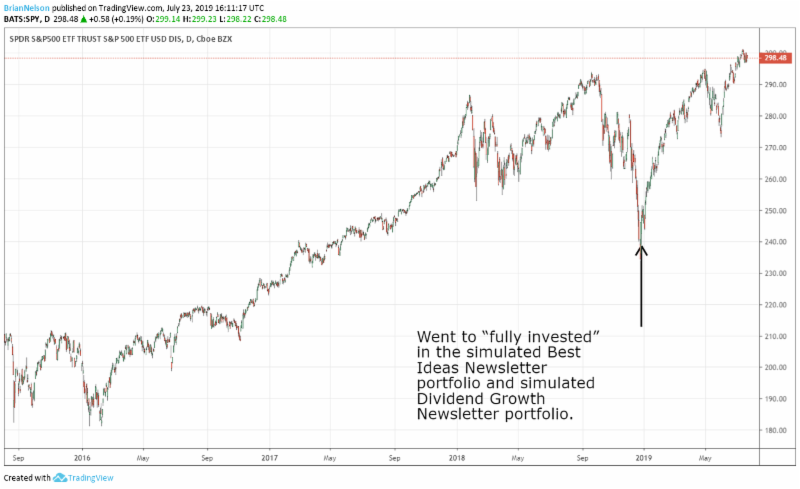

Image: We notified members December 26 that we had moved the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio to a “fully invested” position, from a 30% and 20% cash “weighting” at the high end of the range, respectively.

All things considered, we’re liking what we’re seeing out of second-quarter earnings season. The Fed has the market’s back, we nailed the near-term bottom in December of last year, going all-in to fully-invested in the newsletter portfolios (see image above), and top weightings in the Best Ideas Newsletter portfolio of Facebook (FB) and Visa (V) have been star performers during 2019. Not only have the simulated newsletter portfolios performed wonderfully in recent years, but the good calls we have made are far too many to count. From predicting dividend cuts to saving investors tons of money by warning about impending collapses, to sector calls with MLPs and consumer staples and beyond, it’s frankly hard to find another service doing better. I truly mean that.

I wanted to answer a question about the difference between the Best Ideas Newsletter portfolio and the Exclusive. Many ask: how can we have the Exclusive publication if the Best Ideas Newsletter portfolio represents our best ideas? Well, it comes down to a few things. At Valuentum, we follow a certain number of companies on our website, updating reports and commenting on key developments. This is our coverage list. We source ideas for the Best Ideas Newsletter portfolio from this coverage list and build simulated portfolios around these ideas. In the Best Ideas Newsletter, we call the portfolio our Best Ideas Newsletter portfolio, and it targets long-term capital appreciation. (We also have a Dividend Growth Newsletter portfolio that targets dividend growth).

In 2016, our members said they wanted more and more ideas. We didn’t want to add ideas to the Best Ideas Newsletter portfolio or the Dividend Growth Newsletter portfolio just for the sake of adding ideas though – it would dilute the fantastic expected returns of our best ideas like Visa and many others in the context of portfolio construction. However, what we were able to do is come up with something brand new. We’d only look outside our coverage universe for new ideas to highlight in the Exclusive – an income idea, a capital appreciation idea and a short-idea consideration every month. That way we can still strive for great performance in the Best Ideas Newsletter portfolio to satisfy existing members, while highlighting ideas consistently in the Exclusive to satisfy the new demand with no overlap.

It turns out that both publications are doing fantastic. For those that may be interested in how we think about capital appreciation considerations within the construct of an equity portfolio, the Best Ideas Newsletter portfolio is great. For those looking for new ideas each and every month to consider, the Exclusive may be great to consider. I think both are indispensable. But remember — these are two of our newsletters. We also maintain a vast report and valuation infrastructure on hundreds of companies, and we publish ongoing thoughts commentary and fair value estimates on our website, not to mention a High Yield Dividend Newsletter. You’re not getting a blog or content farm at Valuentum. Your getting a serious publisher that actually spends considerable resources following companies.

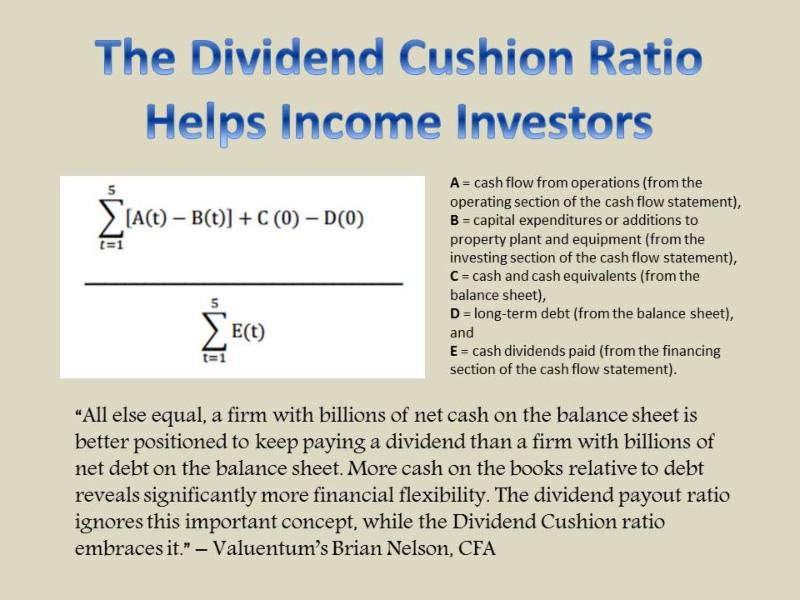

Image: The Dividend Cushion ratio is one of the most powerful financial tools an income or dividend growth investor can use in conjunction with qualitative dividend analysis. The ratio is one-of-a-kind in that it is both free-cash-flow based and forward looking. Since its creation in 2012, the Dividend Cushion ratio has forewarned readers of approximately 50 dividend cuts. We estimate its efficacy at just less than 90%.

I think our report infrastructure is worth the price of a regular membership, with the newsletters and commentary as icing on the cake, not to mention the fantastic performance of the Dividend Cushion ratio all these years. I couldn’t tell you how much we’ve potentially saved readers by warning about the risks of some high-profile dividend cuts. For those that saved money on Kinder Morgan (KMI) and General Electric (GE) or dozens of others like them, the Dividend Cushion ratio, itself, may be worth the monthly price. Just saving a member from one dividend cut could be worth a membership for life.

During the past many years, I have been inviting many of our existing members to upgrade to the Exclusive. There are limited spots. Each time I mention the Exclusive, I am always worried that we may not deliver on the high bar we set for idea generation, but every time, it seems like we do. We’ve also added some extremely talented contributors recently, too. View the team. Success rates* for ideas are much higher than I could have ever imagined, and while I don’t want to raise the price of the Exclusive publication for new members, it is costing more and more to create such great content.

It just comes down to us delivering more and more high-quality content for members. We hope you understand. Plus, there are other very basic newsletters out there that have been around for a while that are charging $1,295/year, and they’re stealing our thunder. Make some noise for us. Others’ track record isn’t anywhere near as good as ours. If you’re interested in our work, be sure to lock in the Exclusive pricing. Select the ‘Subscribe’ button below. Once your payment profile is set up, you’ll receive a registration email from us.

—

—

Button not working? Try this:

Categories Member Articles