Image Source: Hasbro Inc – IR Presentation

By Callum Turcan

Toymaker Hasbro Inc (HAS) posted a second quarter 2019 earnings report on July 23 that was very well received by the market. Revenue was up 9% year-over-year, or 11% when excluding foreign exchange headwinds (a product of a strong US dollar, a common theme for all companies with material overseas sales). Operating profit was up 47% year-over-year on a GAAP basis, reaching 13.0% of sales versus 9.7% of sales in the same period last year (a product of gross margin expansion, cost saving initiatives, and favorable product mix).

While Hasbro’s net income was down sharply year-over-year, that’s entirely due to a major pension expense (the company settled its US pension plan liability) which is considered a special one-time charge. As of this writing, Hasbro is trading near the top end of our fair value estimate range (which stands at $118/share) so we aren’t rushing to add the company back to the Dividend Growth Newsletter portfolio at these levels, but we are intrigued by its impressive quarterly performance and upcoming catalysts. Shares of HAS yield 2.3% as of this writing.

Financials Overview

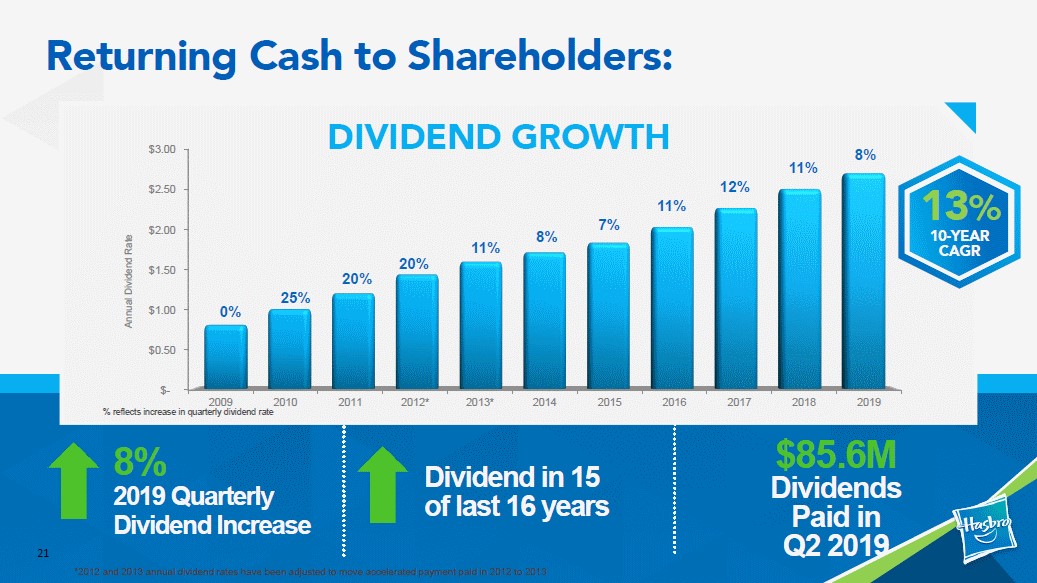

As Hasbro grew and grew, management allocated increasing amounts of cash flow towards rewarding shareholders via per share dividend increases. Its annualized payout has grown from $0.80/share in 2009 to $2.72/share as of this year, which is exemplified in the graphic below. Going forward, we expect Hasbro’s excellent dividend growth story to continue.

Image Shown: We are very supportive of Hasbro’s historical dividend growth profile and we forecast that the company will embark on further significant payout increases in the future, supported by decent dividend coverage. Image Source: Hasbro – IR Presentation

We see Hasbro’s dividend coverage as good considering its relatively modest capital expenditures and projected net operating cash flow growth, but $558 million in net debt at the end of the second quarter of 2019 needs to be taken into consideration. Net debt competes for cash flow as it relates to capital allocation decisions (as in deleveraging considerations), including dividend payments.

Hasbro’s net debt load is very manageable as things stand today. During the first six months of 2019, Hasbro generated $336 million in net operating cash flow and spent $58 million on capital expenditures, leaving $278 million in free cash flow to cover $165 million in dividend payments and $59 million in share buybacks. Dividend increases will also need to compete for capital with share repurchases in the future, another consideration.

Strong MAGIC Performance

Management was very pleased with the performance of MAGIC: THE GATHERING, a card game that started out in the physical world and has since moved into the digital realm, and quite successfully too. Hasbro attributed a large part of its successful second quarter performance to strength at that segment. Down below is a key excerpt from Hasbro’s Chairman and CEO Brian Goldner during the company’s second quarter conference call:

“Behind a retro release slate and continued strength in digital gaming, MAGIC: THE GATHERING delivered an outstanding quarter and first half of the year. The War of the Spark set was extremely well received by players across formats, driving robust quarterly growth in tabletop and digital. Player engagement expanded with the global increases in total unique players and new players. This in turn, drove an incremental increase in MAGIC: THE GATHERING Arena games played with approximately 400 million played in the quarter and 1.1 billion since the game entered open beta in September of last year.

In addition, the Modern Horizon set released during the second quarter exceeded expectations and contributed to higher tabletop revenues during the quarter. This release timing was earlier in 2019 versus last year, when a similar release occurred in the fourth quarter. Importantly, MAGIC’s second quarter performance was driven by growing engagement and monetization of tabletop and arena and through special releases like Modern Horizons that are launched once per year, this year in the second quarter.”

Readers should keep in mind that Hasbro expected MAGIC to perform very well during the first half due to many of the game’s product launches being weighted-towards this period. Even so, Hasbro’s CFO Deb Thomas noted that “we forecasted a strong first half for Magic and it came in ahead of our expectations.” Beating elevated expectations is a great sign of ongoing brand power and user engagement.

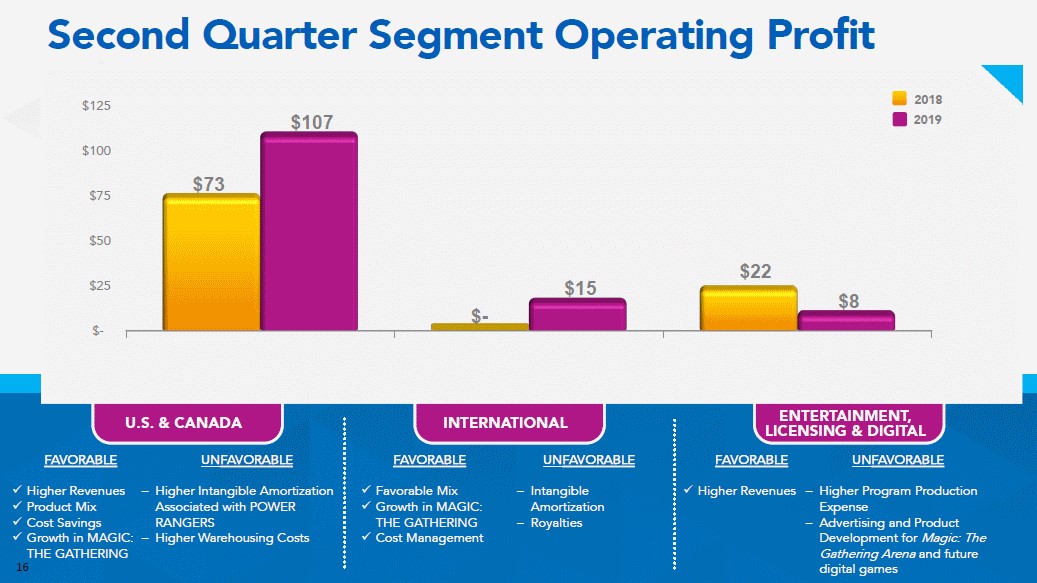

Down below is a look at Hasbro’s performance by segment. Outperformance in the US and Canada, led by MAGIC outperforming, was key to Hasbro’s quarterly earnings beat. MAGIC also performed well internationally, which is a promising sign.

Image Shown: A large part of Hasbro’s outperformance came from its US and Canada segment. Image Source: Hasbro – IR Presentation

Some of Disney’s Magic at Work

Going forward, Hasbro is banking on a different kind of magic of the Walt Disney (DIS) variety to keep the momentum going. Hasbro has a licensing agreement with Disney to produce toys relating to the Marvel and Star Wars properties that was signed back in 2013 and runs through 2020. Marvel toy sales performed decently in the second quarter when removing foreign currency headwinds from the picture due to the release of Avengers: End Game and Spider-Man: Far From Home according to management. Hasbro also fought hard to win the rights to produce Disney’s Princess toys, including those associated with the Frozen and Snow White properties, and that agreement went into force in 2016. Note that Hasbro won the rights to produce those toys over its main competitor Mattel Inc (MAT), which had the licensing agreement previously.

Disney is releasing Frozen 2 this upcoming November, following in the footsteps of the very popular animated movie Frozen. Furthermore, the latest Star Wars movie (Star Wars: The Rise of Skywalker) is coming out in December 2019, providing two major catalysts for Hasbro’s toy sales. Additionally, keep in mind that these properties cater to a wide audience. Families and children love Frozen, all generations (save perhaps for the youngest among us) love Star Wars, granting Hasbro multiple avenues for upside. Hasbro’s management team mentioned that the related toy products should hit the shelves by early October, when interest in the upcoming blockbuster movie launches should start to build. Below is relevant commentary from Hasbro’s management highlighting their strategy as it relates to leveraging Disney’s magic (emphasis added):

“We’ll be supporting all the elements of the Star Wars program and launch. We have really an amazing array of new Star Wars product in support of the film, in support of the Fallen Order video game, in support of The Mandalorian, which begins on Disney Plus… the Star Wars items continue to be top sellers…

Year-to-date, in the — or I should say in the second quarter, we’re very happy to see in the U.S. that the new initiatives we have for our entire fashion doll lineup around our Disney brands, including Princess and FROZEN are up. And so we’re seeing new momentum as a result of new product innovation, the support of Aladdin, as well as the comfy Princess segment that we spoke about before, new ways to look at our Princesses in a more modern way. And then, we’re very excited about Frozen 2 which comes in the fourth quarter.

So clearly, not only the fourth quarter will be positively impacted by all the Disney initiatives, we certainly believe that 2020 gets a major lift as a result of the Disney initiatives. We’ve seen how Marvel has contributed to performance in the quarter and year-to-date.”

Concluding Thoughts

Hasbro posted a great quarter with top-line growth and margin expansion highlighting the powerful pull its brands and properties have with consumers, both in North America and abroad. With several upcoming catalysts in the fourth quarter, Hasbro may be able to follow up a strong first half with a solid second half performance. Furthermore, management seems optimistic about Hasbro’s trajectory heading into 2020. We aren’t looking to add Hasbro back to the Dividend Growth Newsletter portfolio due to shares of HAS already running up to the top end of our fair value estimate range, but appreciate what management is trying to accomplish. Definitely one for the radar.

Leisure Industry – AOBC CCL FUN CLCT HAS IGT MAT RCL SIX WWE

Related: CLCT

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.