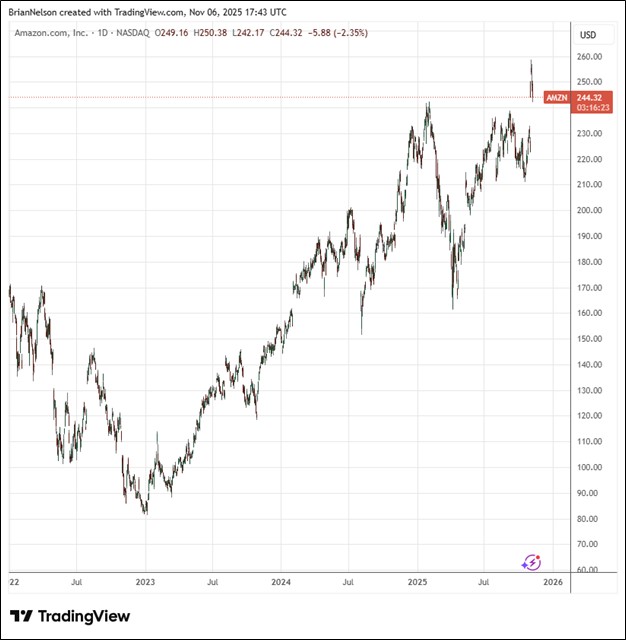

Image Source: TradingView

By Brian Nelson, CFA

Amazon (AMZN) recently reported third quarter results that beat expectations for both revenue and adjusted earnings per share. Net sales increased 13%, to $180.2 billion, in the third quarter, which compares to $158.9 billion in the same quarter a year ago and was nearly $3 billion more than expected. Excluding foreign exchange impacts, net sales increased 12% compared to the third quarter of last year. North America segment sales increased 11%, international segment sales increased 14%, while AWS segment sales advanced 20% year-over-year, to $33 billion. Adjusted operating income came in at $21.7 billion versus $17.4 billion in the same period a year ago. Net income increased to $21.2 billion in the quarter, to $1.95 per diluted share, up from $15.3 billion, or $1.43 per diluted share, in the third quarter of 2024, and $0.37 better than expected.

Management had the following to say about the quarter:

We continue to see strong momentum and growth across Amazon as AI drives meaningful improvements in every corner of our business. AWS is growing at a pace we haven’t seen since 2022, re-accelerating to 20.2% YoY. We continue to see strong demand in AI and core infrastructure, and we’ve been focused on accelerating capacity – adding more than 3.8 gigawatts in the past 12 months. In Stores, we continue to realize the benefits of innovating in our fulfillment network, and we’re on track to deliver to Prime members at the fastest speeds ever again this year, expand same-day delivery of perishable groceries to over 2,300 communities by end of year, and double the number of rural communities with access to Amazon’s Same-Day and Next-Day Delivery.

For the twelve months ended September 30, Amazon’s operating cash flow increased 16%, to $130.7 billion, better than the $112.7 billion it registered for the trailing twelve months last year. Free cash flow came in at $14.8 billion for the trailing twelve months, down from $47.7 billion for the trailing twelve months last year, driven by a $50.9 billion increase in purchases of property and equipment. Looking to the fourth quarter of 2025, net sales are expected to be between $206-$213 billion, or to grow 10%-13%. The guidance includes a favorable impact of about 190 basis points from foreign exchange rates. Operating income is expected to be between $21-$26 billion, compared with $21.2 billion in the fourth quarter of 2024. We thought Amazon’s third quarter and outlook were impressive, and we continue to like shares in the Best Ideas Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.