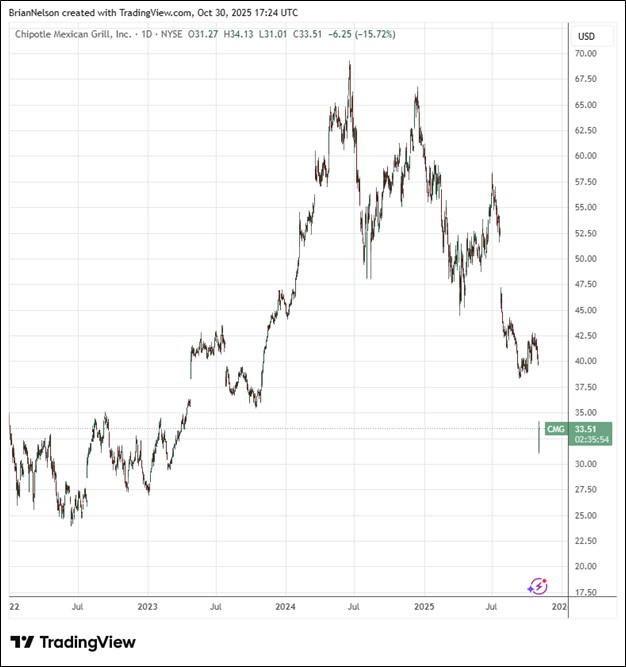

Image Source: TradingView

By Brian Nelson, CFA

On October 29, Chipotle (CMG) reported disappointing third quarter results with revenue missing the mark and non-GAAP earnings per share coming in-line with expectations. In the quarter, total revenue increased 7.5%, to $3 billion, while comparable restaurant sales increased 0.3%, bolstered by a 1.1% increase in average check, partially offset by lower transactions of 0.8%.

Chipotle’s operating margin was 15.9%, a decline from 16.9%, while its restaurant level operating margin also fell to 24.5% from 25.5% previously, as the company faced higher protein and labor costs as well as tariff pressures. Adjusted diluted earnings per share increased 7.4%, to $0.29, in the quarter. It opened 84 company-owned restaurants, with 64 locations including a Chipotlane drive thru, as well as two international partner-operated restaurants.

Management had the following to say about the results:

While we continue to see persistent macroeconomic pressures, our extraordinary value proposition and brand strength remain strong. Our best-in-class teams are focused on doubling down on restaurant execution, sharpening our marketing message, accelerating menu innovation and creating more engaging digital experiences to ensure we emerge stronger and get back to driving positive transaction growth.

For the first nine months of 2025, Chipotle generated $1.69 billion in cash from operations and spent $468.9 million in property and equipment, resulting in free cash flow of $1.22 billion. Looking to all of 2025, management expects full year comparable restaurant sales to decline in the low-single-digit range and to open 315-345 new company-owned restaurants, with over 80% having a Chipotlane. For 2026, management expects to open 350-370 new restaurants, including 10-15 international partner-operated restaurants, with over 80% of company-owned restaurants having a Chipotlane. Though Chipotle’s business is under pressure, we continue to like the long-term growth story. Shares remain an idea in the Best Ideas Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.