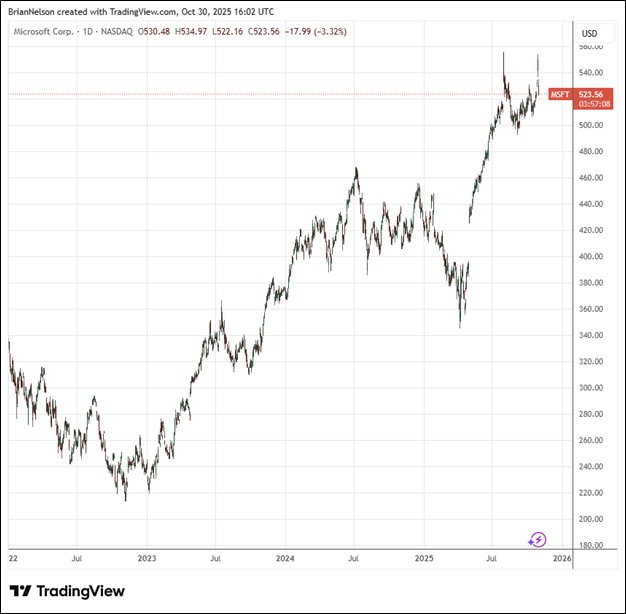

Image Source: TradingView

By Brian Nelson, CFA

On October 29, Microsoft (MSFT) reported excellent first quarter fiscal 2026 results with revenue and non-GAAP earnings per share coming in ahead of expectations. Revenue increased 18% (up 17% in constant currency), while operating income jumped 24% (up 22% in constant currency). Non-GAAP net income was $30.8 billion, increasing 22% (up 21% in constant currency), while non-GAAP diluted earnings per share came in at $4.13, increasing 23% (up 21% in constant currency).

Management had the following to say about the results:

Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact. It’s why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead.

We delivered a strong start to the fiscal year, exceeding expectations across revenue, operating income, and earnings per share. Continued strength in the Microsoft Cloud reflects the growing customer demand for our differentiated platform.

Microsoft’s Azure and other cloud services revenue increased 40% (up 39% in constant currency) in the quarter. The company returned $10.7 billion to shareholders in the form of dividends and share repurchases during the first quarter of fiscal 2026. Looking to the fiscal second quarter, revenue is targeted to be between $79.5-$80.6 billion, growth of 14%-16%, compared to expectations of $80.08 billion. Azure is expected to grow 37% in constant currency in the quarter “as demand remains significantly ahead of the capacity (it) has available.”

As it relates to capital spending, Microsoft is increasing its spend on GPUs and CPUs, where total spending will increase sequentially and its fiscal 2026 growth rate will be higher than that of fiscal 2025. Though some expected more from Microsoft, we thought the quarter and outlook was solid. The company remains a core holding in the newsletter portfolios.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.