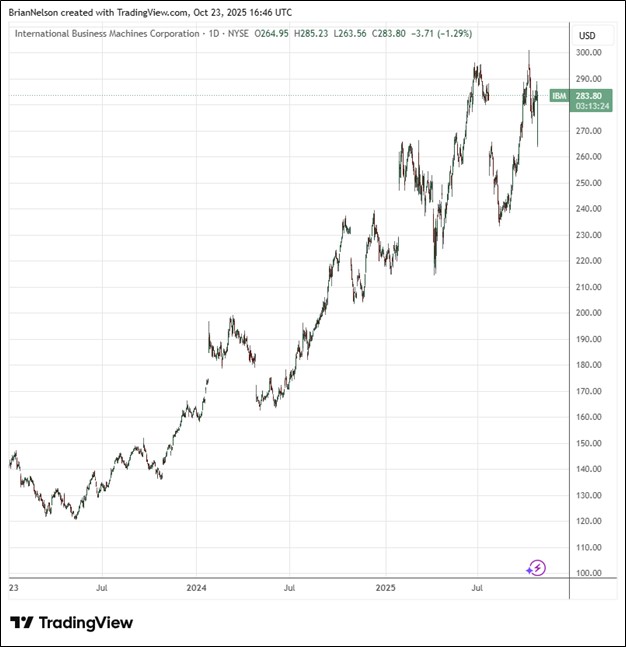

Image Source: TradingView

By Brian Nelson, CFA

On October 22, IBM (IBM) reported third quarter results that exceeded consensus expectations on both the top and bottom lines. Revenue of $16.3 billion was up 9% (7% in constant currency), as software revenue grew 10% (9% in constant currency), consulting revenue grew 3% (2% in constant currency), and infrastructure revenue grew 17% (15% in constant currency). Operating (non-GAAP) gross profit margin totaled 58.7% in the quarter, up 1.2 percentage points, while its operating (non-GAAP) pre-tax income margin totaled 18.6%, up 2 percentage points. Year-to-date, net cash from operating activities came in at $9.2 billion with free cash flow of $7.2 billion.

Management had the following to say about the quarter:

This quarter we accelerated performance across all of our segments, and again exceeded expectations for revenue, profit and free cash flow. Clients globally continue to leverage our technology and domain expertise to drive productivity in their operations and deliver real business value with AI. Our AI book of business now stands at more than $9.5 billion. Given the strength of our business, we are raising our full-year outlook for revenue growth and free cash flow.

New innovation, the strength and diversity of our portfolio, and our disciplined execution led to acceleration in revenue growth and profit in the quarter. Consistent focus on the fundamentals of our business delivered double-digit growth in adjusted EBITDA, and drove another quarter of strong free cash flow, the fuel for our investments and ability to return value to shareholders.

Looking to full-year 2025 expectations, IBM now expects constant currency revenue growth of more than 5%, with free cash flow now expected to be about $14 billion. IBM ended the third quarter with $14.9 billion of cash and marketable securities, up $0.1 billion from year-end 2024. Debt, including IBM Financing debt of $11.3 billion, totaled $63.1 billion, up $8.1 billion year-to-date. IBM continues to pay a regularly quarterly dividend of $1.68 per common share and has paid consecutive quarterly dividends every year since 1916. IBM is one that we’re watching closely for the Dividend Growth Newsletter portfolio, but we remain on the sidelines at this time. Shares yield 2.3% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.