Image Source: Realty Income

By Brian Nelson, CFA

Realty Income (O) recently reported second quarter results with revenue exceeding the consensus forecast, but funds from operations coming in-line with expectations. In the quarter, net income available to common shareholders was $0.22 per share, while adjusted funds from operations (AFFO) came in at $1.05 per share. The REIT invested $1.2 billion at an initial weighted average cash yield of 7.2% in the quarter, while net debt to annualized pro forma adjusted EBITDAre was 5.5x. It achieved a rent recapture rate of 103.4% on properties re-leased in the quarter.

Management had the following to say about the results:

Realty Income’s ability to deliver attractive, consistent total operational returns across economic cycles reflects the fundamental strength of our platform, combining the benefits of scale, diversification, and disciplined execution. As demand for durable income solutions accelerates amidst a growing retiree demographic, and as corporations increasingly seek to unlock capital from real estate, we believe our model is well-positioned to thrive.

Underscoring the power and breadth of this platform, we deployed $1.2 billion into investments during the second quarter at an initial weighted average cash yield of 7.2%. These results were bolstered by our growing presence in Europe, which accounted for 76% of our investment volume. Supported by consistent first half operating results and a robust pipeline of opportunities, we’re pleased to increase our 2025 investment guidance to approximately $5.0 billion and raise the low-end of our AFFO per share guidance to a range of $4.24 – $4.28.

With global reach for product, a data-driven approach to underwriting and portfolio management, and access to a deep and diverse pool of capital, Realty Income offers a unique value proposition. Looking ahead, we remain focused on generating favorable risk-adjusted returns and delivering consistent, long-term value to our shareholders.

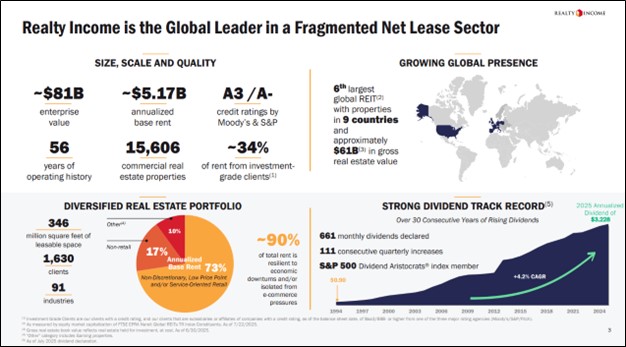

In June 2025, Realty Income announced its 111th consecutive quarterly dividend increase and its 131st increase since it was listed on the NYSE. The amount of monthly dividends paid per share increased 3.7% in the quarter, to $0.806, representing roughly 76.8% of its adjusted diluted AFFO. As of June 30, Realty Income had $5.1 billion of liquidity, including cash and cash equivalents of $800.4 million, while net debt stood at $28.5 billion. Looking to 2025, the company lowered its guidance for net income per share, but it increased the low end of AFFO per share to the range of $4.24-$4.28 from $4.22-$4.28 previously. Investment volume was increased to approximately $5 billion, up from $4 billion previously. Realty Income’s dividend remains on solid ground, and the REIT yields 5.5% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.