Image Source: TradingView

By Brian Nelson, CFA

On September 9, Oracle (ORCL) reported fiscal first quarter 2026 results that came in below expectations, but the firm’s remaining performance obligations surged 359% year-over-year in both USD and constant currency, to $455 billion. Total revenue in the quarter was up 12% in USD and 11% in constant currency. Cloud revenues (IaaS plus SaaS) were up 27% in constant currency, to $7.2 billion, in the quarter. Cloud Infrastructure (IaaS) revenue increased 54% in constant currency, while Cloud Application (SaaS) revenue increased 10% in constant currency. Sales of Fusion Cloud ERP (SaaS) were up 16% in constant currency in the quarter, while sales of NetSuite Cloud ERP (SaaS) were up 15% in constant currency. Non-GAAP earnings per share in the quarter came in at $1.47, up 6% year-over-year.

Management had the following to say about the performance:

We signed four multi-billion-dollar contracts with three different customers in Q1. This resulted in RPO contract backlog increasing 359% to $455 billion. It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build. Over the next few months, we expect to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars. The scale of our recent RPO growth enables us to make a large upward revision to the Cloud Infrastructure portion of Oracle’s overall financial plan which we will be presenting in detail next month at the Financial Analyst Meeting. As a bit of a preview, we expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. Most of the revenue in this 5-year forecast is already booked in our reported RPO. Oracle is off to a brilliant start to FY26.

MultiCloud database revenue from Amazon, Google and Microsoft grew at the incredible rate of 1,529% in Q1. We expect MultiCloud revenue to grow substantially every quarter for several years as we deliver another 37 datacenters to our three Hyperscaler partners, for a total of 71. And next month at Oracle AI World, we will introduce a new Cloud Infrastructure service called the ‘Oracle AI Database’ that enables our customers to use the Large Language Model of their choice—including Google’s Gemini, OpenAI’s ChatGPT, xAI’s Grok, etc.—directly on top of the Oracle Database to easily access and analyze all their existing database data. This revolutionary new cloud service enables the tens of thousands of our database customers to instantly unlock the value in their data by making it easily accessible to the most advanced AI reasoning models. Oracle AI Cloud Infrastructure and the Oracle MultiCloud AI Database will both contribute to dramatically increasing cloud demand and consumption over the next several years. AI Changes Everything.

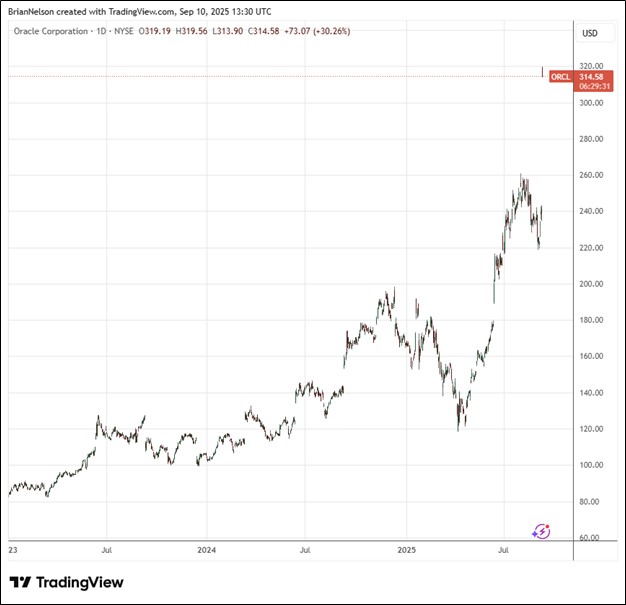

Oracle’s non-GAAP operating income in the fiscal first quarter of 2026 was $6.2 billion, up 9% in USD and up 7% in constant currency. Non-GAAP net income was $4.3 billion in the quarter, up 8% in USD and up 6% in constant currency. We were impressed by the company’s remaining performance obligations growth in the quarter and management’s guidance calling for Oracle’s Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. Management noted that most of the revenue in this 5-year forecast is already booked in its reported remaining performance obligations. Shares of Oracle surged on the news, and we continue to like Oracle in the newsletter portfolios.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.