Image Source: Nvidia

By Brian Nelson, CFA

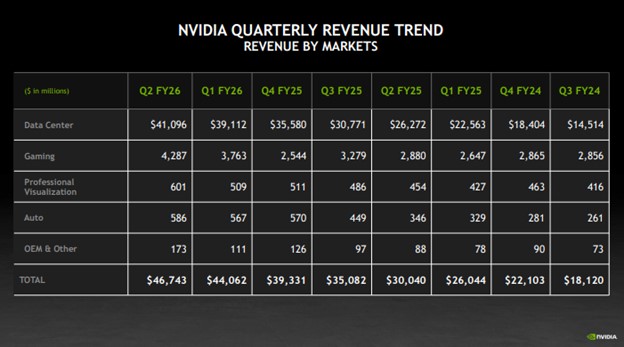

On August 27, market darling Nvidia (NVDA) reported better than expected fiscal second quarter results with both revenue and non-GAAP earnings per share coming in ahead of the consensus forecast. Total revenue increased 56% from the year-ago period, to $46.74 billion (consensus was at $46.13 billion), with Data Center revenue of $41.1 billion advancing by a similar clip, the latter coming in slightly below the consensus estimate of $41.29 billion.

In the quarter, GAAP and non-GAAP gross margins were 72.4% and 72.7%, respectively. GAAP and non-GAAP earnings per diluted share were $1.08 and $1.05, respectively. Consensus was at $1.01. Blackwell Data Center revenue increased 17% on a sequential basis, and there were no H20 sales to China-based customers in the second quarter. Management had the following to say about the results:

Blackwell is the AI platform the world has been waiting for, delivering an exceptional generational leap — production of Blackwell Ultra is ramping at full speed, and demand is extraordinary. NVIDIA NVLink rack-scale computing is revolutionary, arriving just in time as reasoning AI models drive orders-of-magnitude increases in training and inference performance. The AI race is on, and Blackwell is the platform at its center.

During the first half of fiscal 2026, Nvidia returned $24.3 billion to shareholders in the form of share repurchases and cash dividends. At the end of the quarter, Nvidia had $14.7 billion remaining under its share repurchase program and announced that the board approved an additional $60.0 billion to its share buyback authorization.

Looking to the third quarter of fiscal 2026, Nvidia expects revenue to be $54.0 billion, plus or minus 2%, an outlook that does not assume any H20 shipments to China. Consensus was at $52.76 billion. In the fiscal third quarter, GAAP and non-GAAP gross margins are expected to be 73.3% and 73.5%, respectively, plus or minus 50 basis points. The firm expects to end the year with non-GAAP gross margins in the mid-70% range. Nvidia continues to power the market higher, and while results weren’t as bullish as some were expecting, they were strong, nonetheless.

—–

Tickerized for NVDA, AMD, ARM, ASML, TSM, INTC, SMCI, SMH, SOXX, AVGO, QCOM, SPY, QQQ, QQQM, XLK

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.