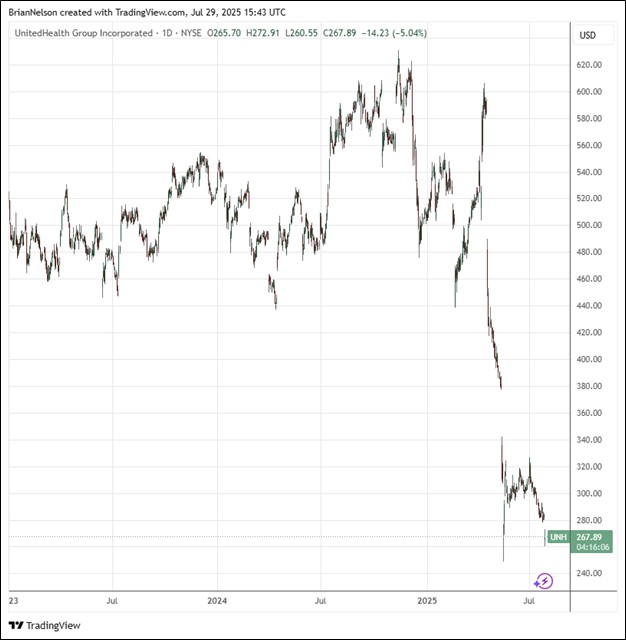

Image Source: TradingView

By Brian Nelson, CFA

UnitedHealth Group (UNH) reported disappointing second quarter results and issued an outlook for 2025 that came in below expectations. The firm’s second-quarter 2025 revenue grew $12.8 billion year-over-year to $111.6 billion thanks to growth at both UnitedHealthcare and Optum. Second-quarter earnings from operations, however, came in at $5.2 billion, down from $7.9 billion in the same period a year ago. Net earnings were $4.08 per share, below the consensus estimate of $4.45 per share. UnitedHealth Group’s second quarter consolidated medical care ratio of 89.4% was up 430 basis points year-over-year.

Management had the following to say about the results:

UnitedHealth Group has embarked on a rigorous path back to being a high-performing company fully serving the health needs of individuals and society broadly. As we strengthen operating disciplines, positioning us for growth in 2026 and beyond, the people at UnitedHealth Group will continue to support the millions of patients, physicians and customers who rely on us, guided by a culture of service and longstanding values.

Looking to 2025, UnitedHealth Group now expects its medical cost ratio to be 89.25% +/- 25 basis points as it grapples with medical cost trends that are significantly exceeding pricing trends and the ongoing effects of Medicare funding restrictions. Its full year 2025 revenue outlook is now targeted in the range of $445.5-$448 billion, below consensus of ~$449 billion, while its adjusted earnings are expected to be at least $16.00 per share, below consensus looking for $20.90 per share.

The new outlook for UnitedHealth Group reflects higher realized and anticipated care trends, but the insurance giant expects to return to earnings growth in 2026. UnitedHealth is contending with rising costs and an investigation from the DOJ related to its Medicare business. We expect to lower our fair value estimate of UnitedHealth Group upon its next update, but we continue to include shares in the newsletter portfolios.

—–

Tickerized for UNH, HUM, CV, ALHC, CNC, MOH, ELV

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.