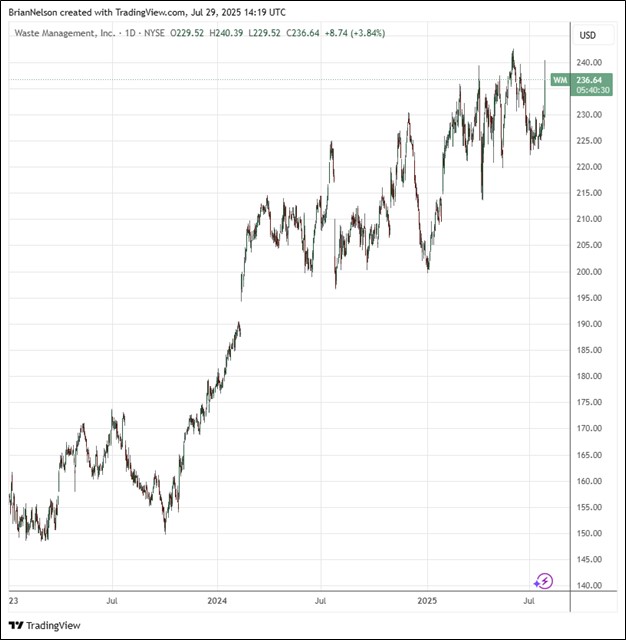

Image Source: TradingView

By Brian Nelson, CFA

On July 28, Waste Management (WM) reported second quarter results that came in better than expected on both the top and bottom lines. Adjusted revenue increased 19% year-over-year, to $6.43 billion, while adjusted income from operations came in at $1.215 billion, up from $1.075 billion in the same quarter a year ago. Adjusted operating EBITDA increased 18.9%, to $1.923 billion. Adjusted net income came in at $777 million, up from $732 million in the second quarter of 2024, while adjusted diluted earnings per share of $1.92 was 6% higher than the quarterly mark last year.

Management had the following to say about the results:

As we described at our recent Investor Day, WM is building distinctive platforms to drive competitive differentiation and fuel a powerful, long-term growth engine to create shareholder value. Our second quarter results are a strong demonstration of our progress on all fronts. Our Collection and Disposal business produced robust organic revenue growth and margin expansion, achieving the Company’s best-ever operating expense margin. We also grew operating EBITDA by double digits in both our Recycling Processing and Sales and WM Renewable Energy segments, as the earnings contributions from investments we have made in our sustainability businesses accelerate. Additionally, we continue to integrate our newest segment, WM Healthcare Solutions, and benefit from the impact of WM’s culture and operational excellence on customer relationships, cost efficiency, and financial results.

We released our 2025 Sustainability Report, We’re Driving Sustainability, earlier this month, highlighting our progress toward our sustainability ambitions, including an impressive 22% reduction in greenhouse gas emissions since 2021. We’re proud of the work our team is doing to advance a more sustainable future for our communities and the environment.

We set a high bar in 2025, and through the first half of the year we have met those high expectations. Our team is focused on serving our customers, optimizing our costs, and innovating to support differentiation and growth. Executing on these priorities is expected to drive strong results in the back half of 2025 and position us to deliver on our guidance, achieve attractive returns on investments and grow shareholder value.

Through the first six months of the year, Waste Management generated $2.75 billion of net cash provided by operating activities, with free cash flow for the first half of the year coming in at $1.29 billion. Looking to all of 2025, management affirmed its adjusted operating EBITDA guidance midpoint of $7.55 billion, while it raised its free cash flow guidance by $125 million, to the range of $2.8-$2.9 billion. Total company revenue is targeted in the range of $25.275-$25.475 billion for the full year, with an adjusted operating EBITDA margin now expected in the range of 29.6%-29.9%, a modest increase from prior guidance. Waste Management is on track to achieve the upper end of its targeted synergies related to WM Health Solutions of $80-$100 million in 2025. We like Waste Management, but don’t include shares in any newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.