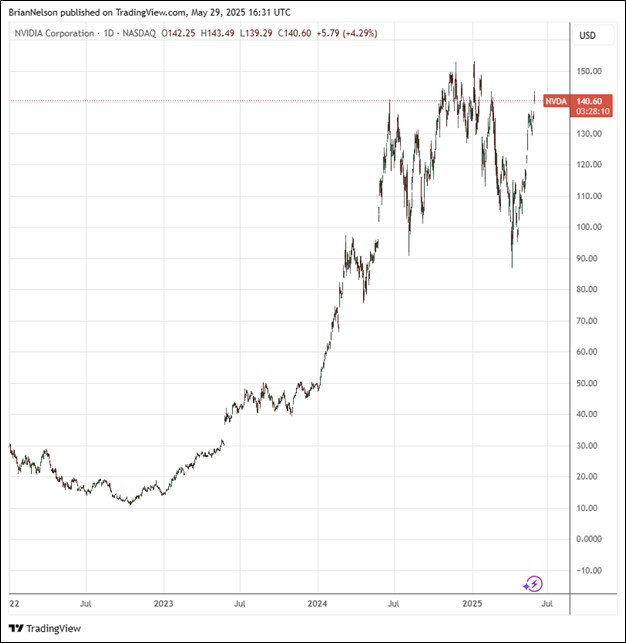

Image: Nvidia’s shares are flirting with all-time highs.

By Brian Nelson, CFA

On May 28, Nvidia (NVDA) reported better than expected first-quarter fiscal 2026 results with revenue and non-GAAP earnings per share coming in higher than the consensus forecasts. Revenue increased 69% from the year-ago period thanks to strength in Data Center revenue, which was up 73% from a year ago. Gaming revenue was a record $3.8 billion, up 42% from a year ago. Professional Visualization revenue was up 19% from a year ago, while first quarter Automotive revenue was up 72% from last year. First-quarter non-GAAP gross margin was 71.3%, while first quarter non-GAAP diluted earnings per share was $0.96.

Management had the following to say about the results:

Our breakthrough Blackwell NVL72 AI supercomputer — a ‘thinking machine’ designed for reasoning— is now in full-scale production across system makers and cloud service providers. Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and NVIDIA stands at the center of this profound transformation.

Looking to the second quarter of fiscal 2026, Nvidia expects revenue to be $45.0 billion, plus or minus 2%, an outlook that reflects a loss in H20 revenue of approximately $8.0 billion due to recent export control limitations into the China market. Had the export controls not been implemented, Nvidia’s outlook would have greatly exceeded consensus estimates, even more so than they did. Non-GAAP gross margin is expected to be 72.0%, plus or minus 50 basis points, in the quarter, and the company is working toward achieving gross margins in the mid-70% range late this year.

Nvidia ended the quarter with $53.7 billion in cash and marketable securities versus long-term debt of $8.5 billion. Net cash provided by operating activities was $27.4 billion in the first quarter, up from $15.3 billion in the year-ago period. Free cash flow was $26.2 billion in the quarter, up from $15 billion in the year-ago period. Nvidia is a net cash rich, free cash flow generating, secular growth powerhouse, and we continue to like shares in the Best Ideas Newsletter portfolio. Our fair value estimate stands at $163 per share.

—–

Tickerized for NVDA, AMD, ARM, ASML TSM, INTC, SMCI, XLK, SCHG.

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.