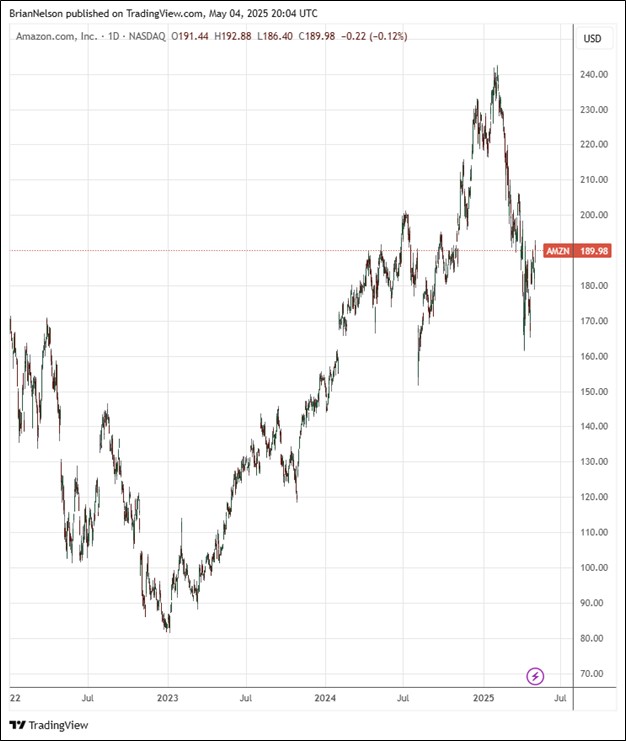

Image: Amazon’s shares are trading near technical support levels.

By Brian Nelson, CFA

Amazon (AMZN) reported solid first quarter results May 1, with revenue and GAAP earnings per share coming in ahead of consensus expectations. Net sales jumped 9%, to $155.7 billion in the first quarter and advanced 10% after adjusting for currency movements. North America segment sales increased 8% year-over-year, International segment sales increased 5% (8% excluding currency movements), while AWS segment sales increased 17%, the latter a very healthy showing despite trailing the 33% growth rate that Microsoft (MSFT) put up in its quarter with respect to Azure.

Amazon’s operating income increased 20.2%, to $18.4 billion in the first quarter, up from $15.3 billion in the same period a year-ago, led by strength in its AWS segment, where division operating income jumped to $11.5 billion compared to $9.4 billion in the first quarter of 2024. Net income increased to $17.1 billion in the first quarter, or $1.59 per diluted share, up from $0.98 in the same period a year ago. Management had the following to say about the quarter:

We’re pleased with the start to 2025, especially our pace of innovation and progress in continuing to improve customer experiences. “From Alexa+ (our next generation of Alexa that’s meaningfully smarter, more capable, and takes actions for customers), to another delivery speed record for our Prime members, to our new Trainium2 chips and Bedrock model expansion that make it easier for AWS customers to train models and run inference more flexibly and cost-effectively, to our first Project Kuiper satellites successfully launching into low earth orbit in our quest to provide broadband access to hundreds of millions of households in rural areas without it today—we’re continuing to find meaningful ways to make customers’ lives easier and better every day.

The e-commerce giant’s operating cash flow increased 15% to $113 billion for the trailing twelve months, up from $99.1 billion for the trailing twelve months ended March 31, 2024. Amazon’s free cash flow, however, suffered from higher capital spending, falling to $25.9 billion on a trailing twelve month basis, compared to $50.1 billion for the trailing twelve months ended March 31, 2024. Amazon was free cash flow negative during the first quarter, as capital spending of $25 billion overwhelmed operating cash flow generation of $17 billion.

Looking to the second quarter, Amazon expects sales to be between $159-$164 billion, or to grow 7%-11% compared with the second quarter of last year. The midpoint was above the consensus forecast of $161.1 billion. Operating income is targeted to be between $13-$17.5 billion in the second quarter, compared with $14.7 billion in the second quarter of 2024, with the midpoint of the range coming in below the consensus forecast. Though the operating income guide for the second quarter wasn’t great, we like the momentum behind AWS and Amazon’s strong balance sheet, which houses $41.2 billion in net cash.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.