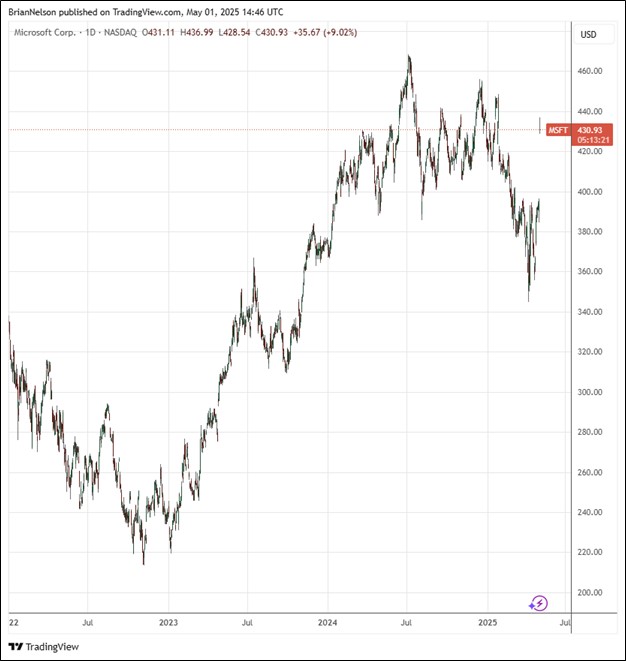

Image: Microsoft’s shares have held up well in this volatile market environment.

By Brian Nelson, CFA

On April 30, Microsoft (MSFT) reported solid third quarter fiscal 2025 results with revenue and GAAP earnings per share coming in higher than what the Street was looking for. Revenue increased 13% (15% in constant currency), and the cloud computing giant leveraged that increase in the top line to a 16% increase in operating income (19% in constant currency). In the quarter, net income increased 18% (19% in constant currency), while diluted earnings per share also increased 18% (19% in constant currency). Management had the following to say about the results:

Cloud and AI are the essential inputs for every business to expand output, reduce costs, and accelerate growth. From AI infra and platforms to apps, we are innovating across the stack to deliver for our customers.

We delivered a strong quarter with Microsoft Cloud revenue of $42.4 billion, up 20% (up 22% in constant currency) year-over-year driven by continued demand for our differentiated offerings.

Revenue in its Productivity and Business Processes segment increased 10% (up 13% in constant currency), while revenue in its Intelligent Cloud segment increased 21% (up 22% in constant currency). Azure and other cloud services experienced revenue growth of 33% (up 35% in constant currency), beating the consensus estimate calling for 31% growth. Revenue in its More Personal Computing segment increased 6% (up 7% in constant currency) in the quarter.

In the quarter, Microsoft returned $9.7 billion to shareholders in the form of dividends and share repurchases. Total cash, cash equivalents, and short-term investments totaled $79.6 billion at the end of the quarter, while debt totaled $42.9 billion. Cash flow from operations increased to $37 billion from $31.9 billion in the three months ended March 31, while capital expenditures were $16.7 billion, up from $11 billion in the prior-year quarter. We continue to be huge fans of Microsoft, and the company delivered in its fiscal third quarter results.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.