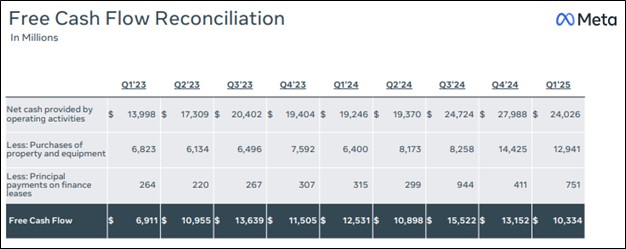

Image: Meta’s free cash flow remains robust.

By Brian Nelson, CFA

On April 30, Meta Platforms (META) reported excellent first quarter results with revenue and GAAP earnings per share coming in ahead of consensus estimates. Revenue increased 16% in the quarter, while income from operations advanced 27%. Meta’s operating margin expanded 3 percentage points in the quarter, to 41%, beating estimates. Net income leapt 35%, while diluted earnings per share increased 37% from last year’s quarter. CEO Mark Zuckerberg had the following to say about the quarter:

We’ve had a strong start to an important year, our community continues to grow and our business is performing very well. We’re making good progress on AI glasses and Meta AI, which now has almost 1 billion monthly actives.

Meta’s family daily active people (DAP) increased 6% year-over-year in the quarter, while ad impressions across its Family of Apps jumped 5%. Average price per ad increased 10% year-over-year. At the end of the quarter, cash, cash equivalents and marketable securities were $70.23 billion. Long-term debt totaled $28.83 billion. Cash flow from operating activities was $24.03 billion in the quarter, up from $19.2 billion in last year’s quarter, while free cash flow was $10.33 billion, down from $12.5 billion in last year’s quarter.

Looking to the second quarter of 2025, Meta Platforms expects total revenue to be in the range of $42.5-$45.5 billion (consensus was $43.8 billion) and total expenses to be in the range of $113-$118 billion, down from its prior outlook of $114-$119 billion. Full year 2025 capital expenditures, including principal payments on finance leases, are targeted at $64-$72 billion, raised from its prior outlook of $60-$65 billion. Management noted that the updated outlook in part reflects additional data center investments to support artificial intelligence efforts. Though Meta is not a large dividend payer, we think its dividend growth prospects are stellar, and the company is included in the Dividend Growth Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.