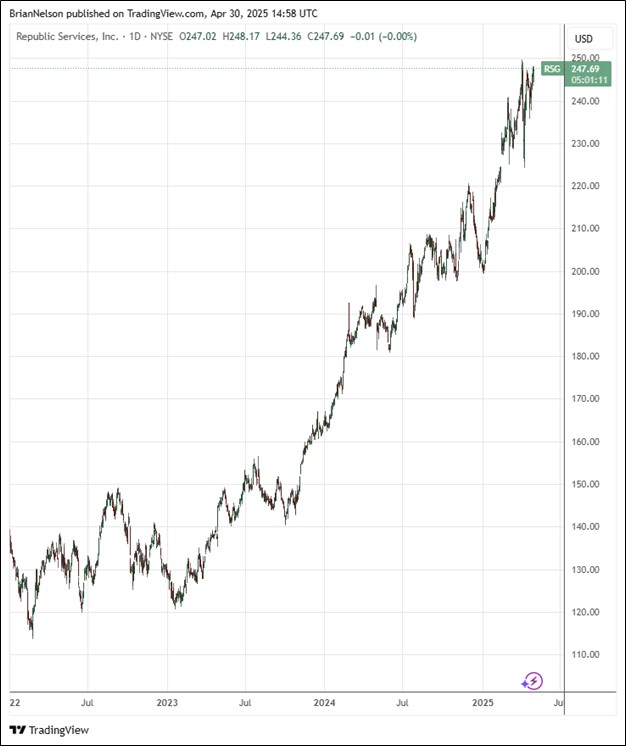

Image: Republic Services’ shares have done quite well the past few years.

By Brian Nelson, CFA

On April 24, trash taker Republic Services (RSG) reported mixed first quarter results with non-GAAP earnings per share outpacing the consensus forecast, but revenue coming in a bit light compared to what the Street was looking for. Total revenue growth was 3.8%, including 2.9 percentage points of organic growth and the balance coming from acquisitions. Revenue growth from average yield increased 4.5%, above the rate of cost inflation, while volume decreased revenue by 1.2%.

Management had the following to say about the quarter:

We are off to a solid start to the year, and our business continues to perform well even with increased volatility in the broader economy. While topline results were impacted by sluggish cyclical volumes and challenging winter weather, we generated high single-digit growth in EBITDA and 140 basis points of adjusted EBITDA margin expansion by pricing ahead of cost inflation and effective cost management. Our ability to produce these results reflects the resiliency of our business model, and the financial benefits we are delivering by investing in our differentiating capabilities.

Republic Services reported net income of $1.58 per diluted share in the first quarter, up from $1.44 per share in last year’s quarter. Adjusted EBITDA came in at $1.27 billion, while its adjusted EBITDA margin expanded 140 basis points from the prior year. The garbage hauler generated cash flow from operations of $1.025 billion and adjusted free cash flow of $727 million. In the quarter, cash returned to shareholders was $226 million, which included $45 million of share repurchases and $181 million of dividends paid. We continue to like Republic Services in the newsletter portfolios.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.