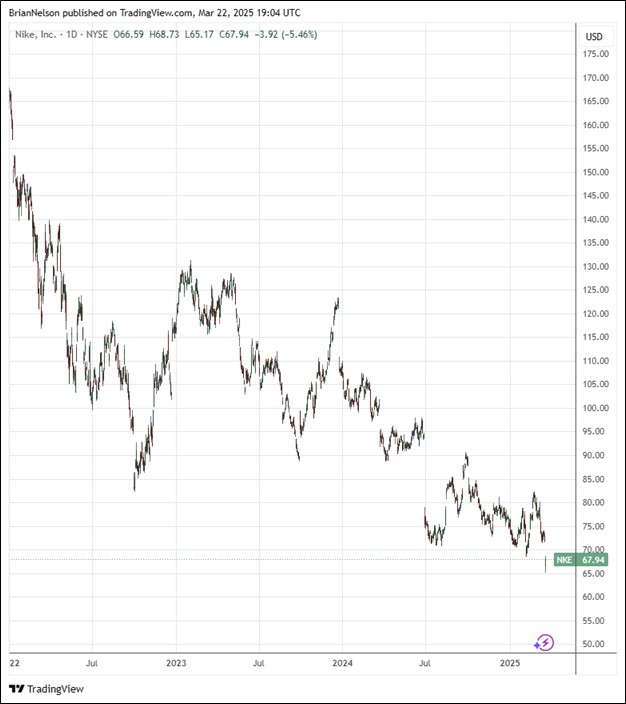

Image: Nike’s shares remain under pressure.

By Brian Nelson, CFA

On March 20, Nike (NKE) reported better than expected third quarter fiscal 2025 results, but the firm’s outlook signaled continued difficulties. Third quarter revenues were down 9% on a reported basis and 7% on a currency-neutral basis. Nike Brand revenues fell 9% on a reported basis and 6% on a currency-neutral basis, as the firm faced declines in all geographies. Nike Direct revenues dropped 12% on a reported basis and 10% on a currency-neutral basis. Wholesale revenues fell 7% on a reported basis and 4% on a currency-neutral basis. Revenues for Converse dropped 18% on a reported basis and 16% on a currency-neutral basis.

Its gross margin tumbled 330 basis points to 41.5% due to higher discounts, higher inventory obsolescence reserves, higher product costs and changes in channel mix. Nike’s selling and administrative expense decreased 8% led by a decline in operating overhead expense, which fell 13% due primarily to restructuring charges in the prior-year period and lower wage-related expenses. Net income dropped 32% in the quarter, while diluted earnings per share fell 30%. Inventories for Nike were $7.5 billion, down 2% compared to the prior year, while cash and short-term investments were $10.4 billion, down roughly $0.2 billion from last year. In the fiscal third quarter, Nike paid dividends of $594 million and bought back $499 million in stock.

Nike had the following to say about its outlook on the conference call: “Our fourth quarter guidance includes our best assessment of these factors based on the data we have available to us today. We expect Q4 revenues to be down in the mid-teens range, albeit at the low end. This includes several points of unfavorable shipment timing in North America, as well as 2 points of negative impact from foreign exchange headwinds. We expect Q4 gross margins to be down approximately 400 basis points to 500 basis points, including restructuring charges during the same period last year. We have included the estimated impact from newly implemented tariffs on imports from China and Mexico.” Nike continues to be in the early stages of a turnaround. Shares yield 2.4% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.