Image Source: Realty Income

By Brian Nelson, CFA

Realty Income (O) recently reported mixed fourth quarter results with the REIT’s top line exceeding the consensus forecast, but funds from operations coming up a little light. For the three months ended December 31, net income was $199.6 million, or $0.23 per share. Adjusted funds from operations (AFFO) per share increased 4%, to $1.05. In the quarter, Realty Income invested $1.7 billion at an initial weighted average cash yield of 7.1%. Net debt to annualized pro forma adjusted EBITDAre was 5.4x.

Management was pleased with the report, as noted in the press release:

I (Sumit Roy, Realty Income’s President and Chief Executive Officer) am pleased with our performance in 2024 as we delivered a 4.8% increase in AFFO per share, representing our 14th consecutive year of annual AFFO per share growth. Throughout the year, we remained disciplined in our capital deployment strategy, culminating in a successful fourth quarter of high-quality investment activity that was prefunded at attractive investment spreads. Our deep access to capital, global reach for proprietary acquisition opportunities, and track record utilizing predictive analytics tools to enhance portfolio management capabilities represent inherent advantages of our unique business model. Looking forward, we have positioned our platform for continued growth and dependable, long-term returns for our shareholders.

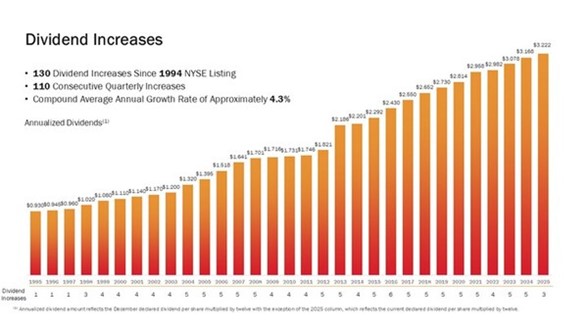

In March 2025, Realty Income announced its 130th dividend increase since it listed on the NYSE in 1994. The annualized dividend amount now stands at $3.222 per share compared to the prior annualized dividend amount of $3.216 per share. Looking to 2025, Realty Income’s net income per share is expected between $1.52-$1.58, AFFO per share is targeted at $4.22-$4.28, while same store rent growth is expected to be approximately 1% on occupancy over 98%. As of December 31, 2024, the REIT had $3.7 billion of liquidity. We like Realty Income but don’t include shares of the REIT in any newsletter portfolio. Shares yield 5.7% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.