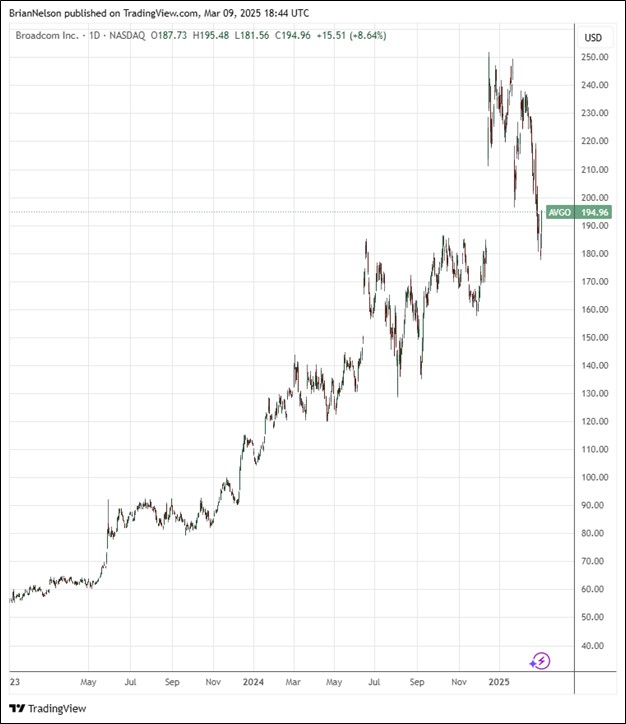

Image: Broadcom’s shares have done quite well since the beginning of 2023.

By Brian Nelson, CFA

Broadcom (AVGO) reported first-quarter fiscal 2025 results on March 6, where revenue and non-GAAP earnings per share topped the consensus estimates. Revenue leapt 25% for the first quarter from the prior-year period, while non-GAAP net income came in at $7.8 billion in the quarter. Adjusted EBITDA was 68% of revenue in the first quarter, coming in at $10.08 billion. Non-GAAP diluted earnings per share was $1.60 for the first quarter.

Management had the following to say about performance in the press release;

Broadcom’s record first quarter revenue and adjusted EBITDA were driven by both AI semiconductor solutions and infrastructure software. Q1 AI revenue grew 77% year-over-year to $4.1 billion and infrastructure software revenue grew 47% year-over-year to $6.7 billion. We expect continued strength in AI semiconductor revenue of $4.4 billion in Q2, as hyperscale partners continue to invest in AI XPUs and connectivity solutions for AI data centers.

Consolidated revenue grew 25% year-over-year to a record $14.9 billion. Adjusted EBITDA increased 41% year-over-year to a record $10.1 billion. Free cash flow was $6.0 billion, up 28% year-over-year.

Broadcom’s cash from operations was $6.1 billion for the first quarter, less capital expenditures of $100 million, resulting in free cash flow of $6 billion, or 40% of revenue. Looking to the second quarter of fiscal 2025, management expects revenue of approximately $14.9 billion, above the $14.59 billion consensus estimate, and second quarter adjusted EBITDA to be 66% of projected revenue. Broadcom ended the quarter with $9.3 billion in cash and cash equivalents and short-and long-term debt of $66.6 billion. Though its balance sheet is saddled with outsize debt, it remains a free cash flow cow.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.