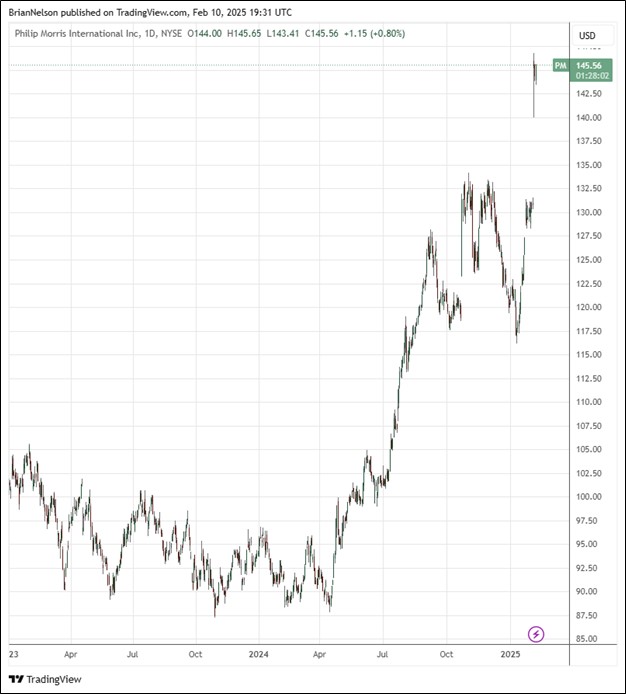

Image: Philip Morris’ shares have done quite well of late.

By Brian Nelson, CFA

Philip Morris (PM) reported better than expected fourth quarter results February 6 that revealed a beat on both the top and bottom lines. In the fourth quarter, net revenue grew 9.2% (9% organically), while gross profit advanced 15.1%. Philip Morris’ smoke-free business accounted for 40% of its total net revenues and approximately 42% of gross profit, up 0.7 percentage points and 0.9 percentage points, respectively, versus the same quarter last year. There is now an estimated 38.6 million adult users of Philip Morris’ smoke-free products, which is up 5.3 million versus December 2023.

Management had the following to say about performance in the press release:

2024 was a remarkable year for PMI. We delivered very strong full-year results driven by the continued growth of IQOS and ZYN in addition to a robust combustibles performance.

The long-awaited U.S. FDA authorization of all ZYN nicotine pouches currently marketed in the U.S. is further evidence of the compelling science supporting smoke-free products. We hope our other pending FDA applications will be accelerated. We also hope other countries follow the example of the U.S. and embrace effective tobacco harm reduction measures. This is especially important in places where smoke-free products are banned, resulting in the perpetuation of combustible cigarette consumption.

With strong momentum across all categories, we are confident that our smoke-free transformation and unparalleled brand portfolio will continue to deliver excellent performance and create value for our shareholders in 2025 and for the long term.

Looking to 2025, Philip Morris’ reported diluted earnings per share is forecast to be in the range of $6.55-$6.68 versus reported diluted earnings per share of $4.52 in 2024. Excluding amortization of intangibles, adjusted diluted earnings per share is targeted in the range of $7.04-$7.17, reflecting 7.2%-9.1% growth versus adjusted diluted earnings per share of $6.57 in 2024.

Also excluding adverse currency impacts, management’s 2025 guidance represents a projected increase of 10.5%-12.5%, to the range of $7.26-$7.39, versus adjusted diluted earnings per share of $6.57 in 2024. For 2025, operating cash flow is expected around $11 billion, while capital spending is expected at approximately $1.5 billion, revealing expected free cash flow of $9.5 billion on the year. We continue to like Philip Morris in the High Yield Dividend Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.