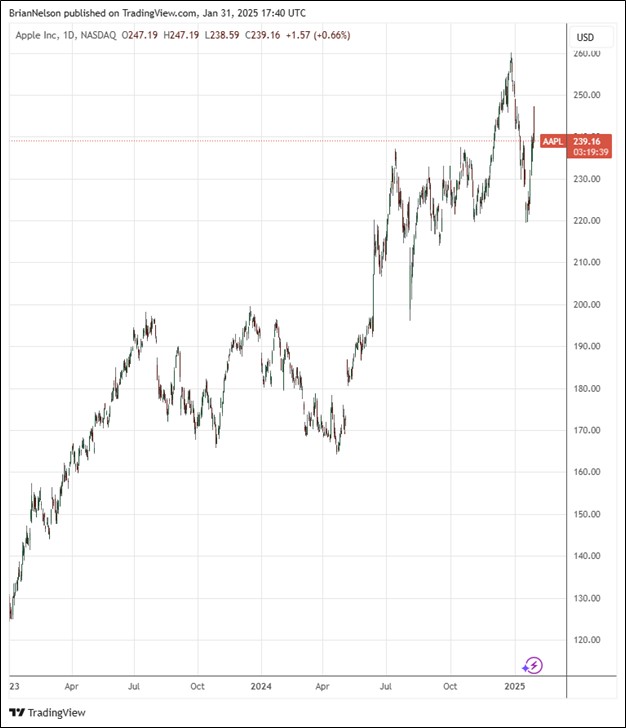

Image Source: TradingView

By Brian Nelson, CFA

On January 30, Apple (AAPL) reported better than expected fiscal first quarter results, with both revenue and GAAP earnings per share exceeding the consensus forecasts. Quarterly revenue was up 4% year-over-year, while quarterly diluted earnings per share advanced 10% year-over-year. Fiscal first quarter services revenue reached a record high, increasing 13.9% from the same period a year ago. Gross margin came in at 46.9%, up from 45.9% in last year’s quarter, while its operating margin came in at 34.5%, up from 33.8% in the year-ago period.

Management was upbeat in the press release:

…Apple is reporting our best quarter ever, with revenue of $124.3 billion, up 4 percent from a year ago. We were thrilled to bring customers our best-ever lineup of products and services during the holiday season. Through the power of Apple silicon, we’re unlocking new possibilities for our users with Apple Intelligence, which makes apps and experiences even better and more personal. And we’re excited that Apple Intelligence will be available in even more languages this April.

Our record revenue and strong operating margins drove EPS to a new all-time record with double-digit growth and allowed us to return over $30 billion to shareholders. We are also pleased that our installed base of active devices has reached a new all-time high across all products and geographic segments.

In the quarter, Apple’s net sales advanced nicely in the Americas, Europe, Japan and the Rest of Asia Pacific regions, but revenue fell 11.1% in Greater China. Mac and iPad sales increased from the same period a year ago, but sales in its iPhone (-0.8%) and Wearables, Home and Accessories (-1.7%) segments faced quarterly declines. Apple ended the quarter with $141.4 billion in cash and marketable securities and $96.8 billion in term debt and commercial paper, good for a solid net cash position. Cash flow from operations dropped to $29.9 billion in the December quarter, while capital spending totaled $2.9 billion, resulting in free cash flow of $27 billion.

During the quarter, Apple returned to shareholders $3.9 billion in dividends and equivalents and $23.3 billion in share repurchases. Looking to the March quarter, management expects total company revenue to grow low to mid-single-digits year-over-year, with Services revenue to grow low double-digits year-over-year. It expects its gross margin to be between 46.5%-47.5%, about in line with the December quarter. We continue to be fans of Apple’s large installed base (2.35 billion active devices) and growing, high-margin Services business, and the company remains a key holding in the newsletter portfolios.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.