Image Source: Microsoft

By Brian Nelson, CFA

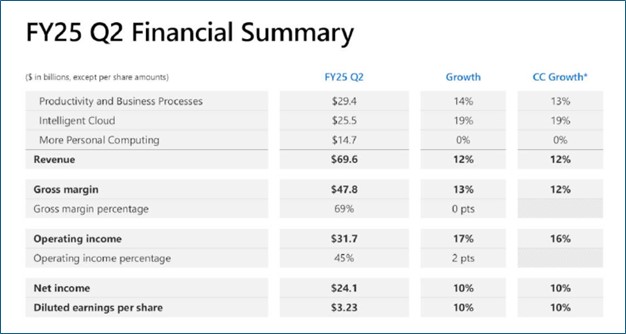

On January 29, Microsoft (MSFT) reported better than expected fiscal second quarter results with revenue and GAAP earnings per share coming in ahead of the consensus forecast. Revenue increased 12% on a year-over-year basis, and Microsoft leveraged that top-line growth into a 17% increase in operating income (up 16% in constant currency). Net income increased 10%, while diluted earnings per share of $3.23 also advanced 10%. Management was upbeat in the press release:

We are innovating across our tech stack and helping customers unlock the full ROI of AI to capture the massive opportunity ahead. Already, our AI business has surpassed an annual revenue run rate of $13 billion, up 175% year-over-year.

This quarter Microsoft Cloud revenue was $40.9 billion, up 21% year-over-year. We remain committed to balancing operational discipline with continued investments in our cloud and AI infrastructure.

On a year-over-year basis, revenue in its Productivity and Business Processes division increased 14% (up 13% in constant currency), revenue in its Intelligent Cloud segment advanced 19%, while revenue in its More Personal Computing division was relatively unchanged. In the quarter, Azure and other cloud services experienced revenue growth of 31%, slightly lower than what the Street was looking for. Total cash and short-term investments were $71.6 billion at the end of the quarter, while total debt was $45 billion.

Microsoft’s cash flow from operations was $22.3 billion in the quarter, up from $18.9 billion in the same period a year ago. Capital spending leapt to $15.8 billion from $9.7 billion in last year’s quarter, and management expects similar spending in the fiscal third and fourth quarters. Free cash flow for the fiscal second quarter came in at $6.5 billion, slightly higher than what it paid in cash dividends during the period.

Looking to the fiscal third quarter, Microsoft expects Azure revenue growth to be between 31%-32% in constant currency. Revenue growth for the fiscal third quarter is expected in the range of $67.7-$68.7 billion, below the consensus forecast of $69.8 billion. For all of fiscal 2025, management expects total revenue to grow double digits, operating expenses to grow in the single-digits, and operating income to grow in the double digits. Operating margins are expected to be up slightly year-over-year. Though Azure revenue growth and fiscal third quarter guidance may have come in a little light of what the Street was looking for, we still like Microsoft as a core idea in the newsletter portfolios.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.