Image Source: Costco

By Brian Nelson, CFA

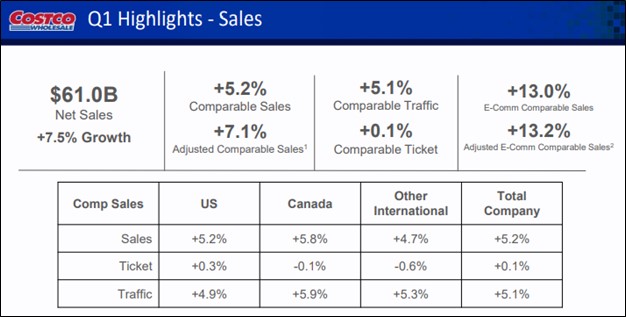

Costco Wholesale (COST) recently reported first quarter results for fiscal 2025, with revenue and non-GAAP earnings per share coming in ahead of expectations. Net sales for the first quarter advanced 7.5%, to $60.99 billion from $56.72 billion in the year ago period. Total comparable store sales, after adjusting for the impact of changes in gasoline prices and foreign exchange, increased 7.1% versus the consensus estimate of 6.3%. Comparable traffic rose 5.1%, while comparable ticket edged higher 0.1%. Costco experienced 13.2% adjusted e-commerce expansion in the period.

Costco shared some fun facts about growth in its business on the conference call:

Our U.S. bakery division has reached new records of 4.2 million pies being sold the three days prior to Thanksgiving.

In our U.S. food courts on Halloween Day, we set a new record of 274,000 whole pizzas being sold. That was an increase of 21%. Our U.S. pharmacy business has prescription growth exceeding 19% for the first quarter, setting new volume records for that business. And lastly, we continue to gain market share with our e-commerce big-and-bulky fulfilled by Costco Logistics.

Costco Logistics completed nearly 1 million deliveries in Q1 and over 196,000 deliveries last week alone. That was a new record as well. The majority of these deliveries were completed in four days from the members ordering their merchandise online.

All of these milestones reflect the continued strength of our business across the membership offering.

ESG Matters

Costco continues to make progress when it comes to ESG considerations. The company is working hard to meet its Scope 1 and 2 direct absolute emissions reduction target of 39% by 2030. “Included in this strategy are smarter operating procedures, lower carbon equipment in (its) warehouses and transportation networks, upgraded LED lighting, and the purchase of clean energy (2023 Highlights).” Costco budgets 1% of its pre-tax profits for select charitable contributions, and in fiscal 2023, that amount was greater than $75 million. It also makes food and non-food donations from its warehouses, accounting for millions of donated meals while keeping “usable goods out of landfills.” The company is working to replace diesel-powered equipment with electric equipment, and new packaging helped to eliminate “14.4 million pounds of plastic in (its) Kirkland Signature and fresh produce packaging.”

Concluding Thoughts

During the fiscal first quarter, Costco’s membership income grew 7.8% year-over-year, while paid memberships grew 7.6% year-over-year, to 77.4 million. Total cardholders increased 7.2% year-over-year, to 138.8 million. Its worldwide renewal rate remained healthy at 90.4%. Net income for the quarter came in at $3.82, after excluding a $0.22 per share tax benefit related to stock-based compensation, beating the consensus forecast by a few pennies per share. Excluding discrete tax-related benefits occurring in both the most recently reported quarter and the same period last year, net income and diluted earnings per share advanced 9.9% and 9.8%, respectively. Costco’s fiscal first quarter was solid, but with the company trading at 50x forward earnings, we’re looking elsewhere.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.