Image Source: Foot Locker

By Brian Nelson, CFA

Foot Locker (FL) reported lower-than-expected third quarter results on December 4, with revenue and non-GAAP earnings per share coming in below the consensus forecasts. The company also lowered its 2024 sales and non-GAAP earnings per share outlook.

Total revenue fell 1.4% year-over-year (down 2.2% on a constant currency basis) in the quarter, with comparable store sales up 2.4%. Foot Locker and Kids Food Locker experienced comparable store sales growth of 2.8%, while Champs Sports and WSS experienced comparable store sales growth of 2.8% and 1.8%, respectively. Foot Locker experienced gross margin expansion of 230 basis points year-over-year in the quarter, but the company’s non-GAAP earnings per share of $0.33 was lower than expectations.

Management spoke of a more promotional environment and softening trends in its business:

Our team’s continued focus on execution drove positive comparable sales trends and meaningful gross margin expansion in the quarter. However, our third quarter top- and bottom-line performance fell short of our expectations. Consumer spending trends softened following the peak Back-to-School period in August, and the promotional environment was more elevated than anticipated. At the same time, we continued to demonstrate progress with our Lace Up Plan, including further cementing our leadership position at the heart of basketball and sneaker culture. In the quarter, we continued the rollout of our Foot Locker ‘Home Court’ experience in collaboration with Nike and Jordan Brand, and we also announced a multi-year partnership with the legendary Chicago Bulls franchise.

While our trends in early November landed below our expectations as consumers held back their spending ahead of the holiday season, we saw a meaningful and positive acceleration over the key Thanksgiving week period, especially in stores. Despite that strong performance, we are taking a more cautious view and are lowering our full-year sales and earnings outlook due to a more promotional environment and softer consumer demand outside of key selling periods. We remain focused on unlocking opportunities through our new Reimagined stores and refresh program, revamped digital experience, including the recent launch of our new mobile app, and stronger customer engagement through our enhanced FLX Rewards Program. We are confident that our strategies will drive sustainable shareholder value creation as we progress towards our 8.5-9% EBIT margin target by 2028.

At the end of the quarter, Foot Locker reported cash and cash equivalents of $211 million versus total debt of $445 million. Merchandise inventories came in 6.3% lower than at the end of last year’s quarter. During the third quarter, the company closed 24 stores, while it opened 10 new stores and remodeled or relocated 20 stores. For the thirty-nine weeks ended November 2, cash flow from operations came in at $98 million, while capital spending was $185 million, revealing continued free cash flow burn.

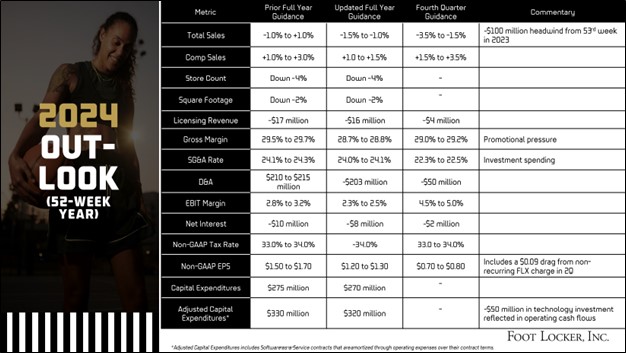

Looking to all of 2024, Foot Locker now expects sales growth to be -1.5% to -1% from -1% to +1% previously and comparable store sales growth of 1%-1.5%, down from the prior range of 1%-3%. It also lowered its EBIT margin outlook for the full year 2024 to the range of 2.3%-2.5% from 2.8%-3.2% previously. Non-GAAP earnings per share for the year is now targeted in the range of $1.20-$1.30 from $1.50-$1.70 previously. Given the disappointing outlook, we’re viewing Foot Locker as a put option idea candidate.

—–

Tickerized for FL, NKE, ADDYY, ONON, DECK, LULU, UA, UAA, SKX

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.