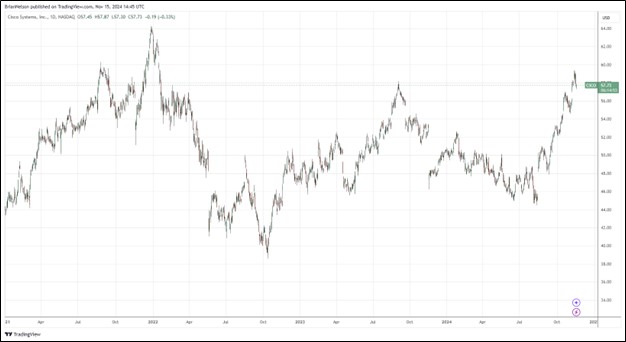

Image: Cisco’s shares have been choppy the past couple years.

By Brian Nelson, CFA

Cisco Systems (CSCO) reported better than expected fiscal first quarter 2025 results on November 13. Revenue of $13.8 billion came in at the high end of its guidance range, down 6% but above consensus by $70 million, while non-GAAP earnings per share of $0.91 came in above its guidance range, beating the consensus forecast by $0.04. Product orders were up 20% year-over-year and up 9% excluding the recent acquisition of Splunk. Subscription revenue now accounts for 57% of its total revenue.

Management had the following to say about the quarter:

Cisco is off to a strong start to fiscal 2025. Our customers are investing in critical infrastructure to prepare for AI, and with the breadth of our portfolio, we are uniquely positioned to capitalize on this opportunity.

Revenue, gross margin and EPS in Q1 were at the high end or above our guidance range, generating strong operating leverage. We are focused on solid execution and operating discipline while making strategic investments to drive innovation and growth.

Total product revenue was down 9% in the quarter, while services revenue advanced 6%. Excluding its acquisition of Splunk, total revenue fell 14%. Revenue by geographic segment showed Americas falling 9%, EMEA down 2%, and APJC (Asia Pacific, Japan, and China) up 1%. Though revenue faced pressure, gross margins improved. On a non-GAAP basis, total gross margin, product gross margin, and services gross margin came in at 69.3%, 68.9%, and 70.3%, all better than the first quarter of 2024. The company’s total non-GAAP gross margin was the highest it has seen in more than 20 years.

Cisco’s non-GAAP operating income of $4.7 billion in the quarter was down 12%, with a non-GAAP operating margin of 34.1%. The company’s non-GAAP earnings per share in the quarter of $0.91 reflected a decrease of 18%. Cash flow from operating activities was $3.7 billion in the first quarter, up 54% compared to the first quarter of fiscal 2024. Capital spending advanced to $217 million versus $134 million in the year ago period, resulting in free cash flow of $3.4 billion. Remaining performance obligations were $40 billion, up 15% in total, with more than half expected to be recognized as revenue over the next 12 months. Deferred revenue was up 7% in total.

Cisco continues to be shareholder friendly. The company returned $3.6 billion to shareholders in the form of share buybacks ($2 billion) and dividends ($1.6 billion) in the quarter. It still has $3.2 billion remaining on its authorized share repurchase program. Cash and cash equivalents were $18.7 billion at the end of the first quarter, compared with $17.9 billion at the end of fiscal 2024. Short- and long-term debt was $32 billion at the end of the quarter. Management had the following to say on the call about its opportunity in artificial intelligence:

…as we look at what’s occurring with AI, there are three key things happening. First, there is significant investment in back-end AI networks with hyperscalers focused on training. Second, as enterprises look to adopt and deploy AI, they need to modernize and secure their infrastructure to prepare for pervasive deployment of AI applications. Finally, the combination of mature back-end models with enterprise AI application deployment will lead to increased capacity requirements on both private and public front-end cloud networks. Cisco is already playing a major role across all three of these significant opportunities and are uniquely positioned to win with the breadth of our product portfolio and our trusted customer relationships.

Looking to fiscal 2025, Cisco Systems expects revenue in the range of $55.3-$56.3 billion, up from a prior view of $55-$56.2 billion, and non-GAAP earnings per share in the range of $3.60-$3.66, up from $3.52-$3.58 previously. We like Cisco’s progression to a subscription base business model, its opportunities in artificial intelligence, while its forward price-to-earnings ratio remains attractive at roughly 16x current fiscal year earnings. The high end of our fair value estimate range is $67 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.