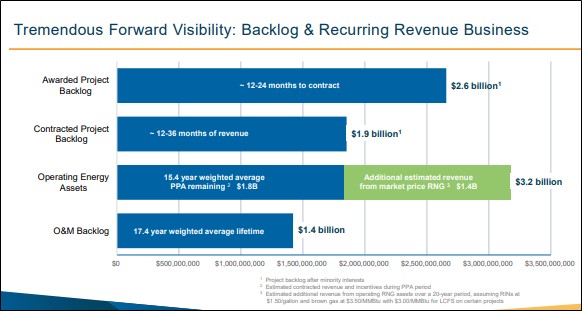

Image: Ameresco’s backlog of future business remains strong and growing.

By Brian Nelson, CFA

On November 7, cleantech integrator and renewable energy asset developer, Ameresco (AMRC) reported mixed third quarter results. Revenue jumped 49.4% in the quarter on a year-over-year basis, while non-GAAP earnings per share missed the consensus forecast by $0.21. Still, adjusted EBITDA in the quarter advanced 43.6% on a year-over-year basis. Cash flow from operations in the quarter was $25.1 million and $34.4 million on an adjusted basis. Management was upbeat in the press release:

Our team continued to deliver excellent results with year-on-year quarterly revenue growth of 49% and record Adjusted EBITDA of over $62 million, growing 44% in the third quarter, reflecting strong demand for Ameresco’s unique blend of services across our customer base. Each of our four business lines achieved strong year-on-year growth, led by Projects, Energy Assets and O&M, where revenues increased at substantial double-digit rates. At the same time, we brought over 40MWe of Energy Assets into operation, resulting in a year-to-date total of 209 MWe – a record number for Ameresco and already above our full year guidance of 200MWe. New business activity remained robust with our total Project Backlog growing to $4.5 billion at the end of the quarter, an increase of 22% from last year. Importantly, our continued focus on contract conversion helped drive a 56% increase in contracted backlog to a record $1.9 billion. We also had a very strong quarter with our recurring O&M business adding over $180 million in additional backlog versus last year.

Projects revenue grew 58.8% in the quarter, while Energy Assets revenue grew 33.4%, O&M revenue advanced 24.6% and Other revenue increased 9.8%. Net income attributable to common shareholders came in at $17.6 million compared to $21.3 million during the third quarter of last year due to higher interest-related and depreciation expenses. Total corporate debt at the end of the quarter was $272.5 million, with a corporate debt leverage ratio of 2.8x, below its 3.5x covenant level. Ameresco ended the quarter with $113.5 million in cash.

Management had the following to say about its outlook:

With our record project backlog, expanding portfolio of operating Energy Assets and growing base of long-term O&M contracts, Ameresco is very well positioned for future growth. As we look ahead to 2025, we believe the need for our smart solutions that provide energy resiliency, cost savings and infrastructure upgrades will continue to be in very high demand. We have all the elements in place to achieve another year of impressive growth in revenue and faster growth in profitability while continuing to capture growing business opportunities.

Looking to full year 2024 guidance, Ameresco expects revenue in the range of $1.7-$1.8 billion, up 27% at the midpoint of the range. Gross margin is targeted in the range of 16%-16.5%, while adjusted EBITDA is targeted to grow 35% at the midpoint of the range, to $210-$230 million. Non-GAAP earnings per share is targeted in the range of $1.15-$1.35. We continue to like Ameresco’s backlog build, as we continue to monitor its debt position and adjusted operating cash flow trends closely. The firm remains an idea in the ESG Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.