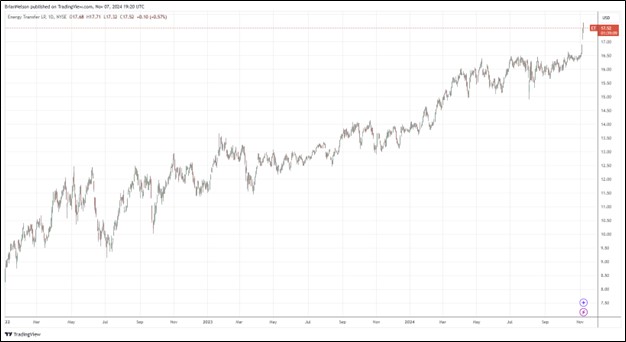

Image: Energy Transfer’s units have done quite well the past couple years, as the pipeline giant now covers distributions with traditional free cash flow.

By Brian Nelson, CFA

Energy Transfer (ET) reported decent third quarter results November 6, even though the midstream energy company missed estimates on both the top and bottom lines. On a diluted basis, net income per common unit advanced to $0.32 from $0.15 in the year ago period. Adjusted EBITDA came in at $3.96 billion compared to $3.54 billion in the three months a year ago. Distributable cash flow for the three months ended September 30 was $1.99 billion, a $4 million increase on a year-over-year basis and in excess of the $1.1 billion in total distributions paid to partners in the quarter.

Energy Transfer’s volume growth was solid in the quarter. Crude oil transportation volumes were up 25%, setting a new record. Crude oil exports were up 49%. Midstream gathered volumes and produced volumes were up 6% and 26%, respectively, setting new records. NGL fractional volumes and transportation volumes also set new records in the quarter. In July 2024, Energy Transfer completed its acquisition of WTG Midstream Holdings, which added roughly 6,000 miles of complementary gas gathering pipelines and nine gas processing plants.

For the nine months ended September 30, Energy Transfer generated $8.9 billion in cash flow from operations, as it spent $2.7 billion in capital expenditures, resulting in traditional free cash flow generation of $6.2 billion, which is well in excess of its distributions to partners, noncontrolling interests, and redeemable noncontrolling interests of $4.9 billion. Energy Transfer ended the third quarter with $299 million in cash and total debt of $59.3 billion. We liked Energy Transfer’s third quarter results, and we’re huge fans of its newfound ability to cover distributions with traditional free cash flow.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.