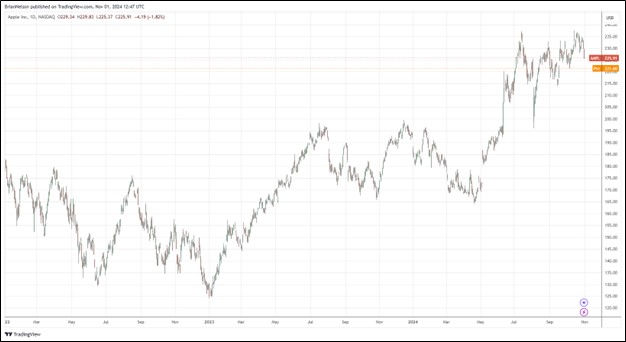

Image: Apple’s shares continue to flirt with all-time highs.

By Brian Nelson, CFA

Apple (AAPL) reported better than expected fiscal fourth quarter results October 31 that showed a beat on both the top and bottom lines. Revenue increased 6% year-over-year, to $94.9 billion, while the company posted adjusted diluted earnings per share of $1.64, up 12% year-over-year, after excluding a one-time charge related to the impact of the reversal of the European General Court’s State Aid decision.

Management had the following to say about the quarter:

Today Apple is reporting a new September quarter revenue record of $94.9 billion, up 6 percent from a year ago. During the quarter, we were excited to announce our best products yet, with the all-new iPhone 16 lineup, Apple Watch Series 10, AirPods 4, and remarkable features for hearing health and sleep apnea detection. And this week, we released our first set of features for Apple Intelligence, which sets a new standard for privacy in AI and supercharges our lineup heading into the holiday season.

Our record business performance during the September quarter drove nearly $27 billion in operating cash flow, allowing us to return over $29 billion to our shareholders. We are very pleased that our active installed 31.2% of devices reached a new all-time high across all products and all geographic segments, thanks to our high levels of customer satisfaction and loyalty.

Products revenue advanced to $70 billion in the quarter, up 4.1% from $67.2 billion in the year-ago quarter. Services revenue increased to $25 billion, modestly below expectations but up 11.9% from the $22.3 billion mark it achieved in last year’s quarter. Gross margin and operating margin were 46.2% (above estimates) and 31.2% in the quarter. Greater China revenue was roughly flat in the quarter from the same period a year ago, below estimates. iPhone sales came in at $46.2 billion, up 5.5% from $43.8 billion in the year-ago period. Mac and iPad sales also advanced, while revenue in its Wearables, Home and Accessories division fell 3% year-over-year.

Management issued the following outlook on the call for the December quarter end:

We expect our December quarter total company revenue to grow low- to mid-single digits year-over-year. We expect Services revenue to grow double-digits at a rate similar to what we reported in the fiscal year 2024. We expect gross margin to be between 46% and 47%. We expect OpEx to be between $15.3 billion and $15.5 billion. We expect OI&E to be around negative $250 million, excluding any potential impact from the mark to market of minority investments. And our tax rate to be around 16%.

Apple ended the quarter with $157.7 billion of cash and marketable securities. Total debt was $106.6 billion at the end of the quarter. For the twelve months ended September 28, cash flow from operations advanced to $118.3 billion from $110.5 billion in last year’s period, while capital spending fell to $9.4 billion from $11 billion in the year-ago period. Free cash flow of $108.8 billion in the fiscal year easily covered the company’s cash dividends paid of $15.2 billion. Apple bought back $94.9 billion in common stock during the fiscal year. Our fair value estimate stands at $226 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.