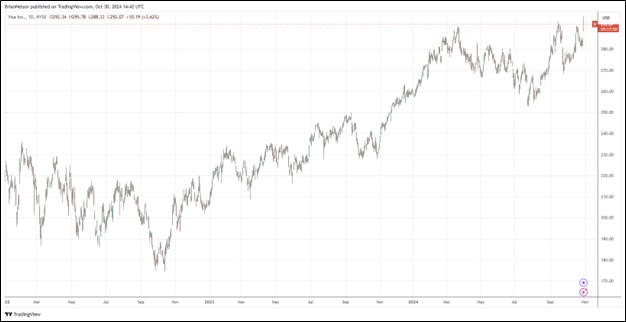

Image: Visa’s shares look poised to break out to new all-time highs.

By Brian Nelson, CFA

Visa (V) reported better than expected fiscal fourth quarter results on October 29 with both revenue and non-GAAP earnings per share outpacing the consensus forecast. Net revenue increased 12% on a year-over-year basis, while non-GAAP net income increased 13%. During the fiscal fourth quarter, on a constant currency basis, payments volume increased 8%, while cross-border volume increased 13% and processed transactions advanced 10%. Non-GAAP earnings per share advanced 16% in the quarter, to $2.71, beating the consensus forecast by $0.13.

Management was upbeat in the press release:

Visa had a robust fourth quarter to finish a very strong fiscal year. I am proud of what our team accomplished, delivering on our financial expectations and enabling our clients with innovative solutions. In the fourth quarter, net revenue and GAAP EPS grew by 12% and 17%, respectively, driven by relatively stable growth in payments volume, cross-border volume and processed transactions plus strong momentum across new flows and value added services. We see tremendous opportunity ahead to grow our business, deliver for our clients and collectively shape the future of commerce.

At the end of the quarter, Visa’s cash and investment securities totaled $17.7 billion, while long-term debt stood at $20.8 billion, reflecting a modest but manageable net debt position. Visa returned $6.8 billion to investors in the form of share repurchases and dividends during the fiscal fourth quarter, while the board increased Visa’s quarterly cash dividend 13%, to $0.59 per share. For the twelve months ended September 30, Visa put up a 65.7% operating margin and a free cash flow margin of 52%. We continue to like Visa as a top idea in the Best Ideas Newsletter portfolio. The high end of our fair value estimate range stands at $329 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.