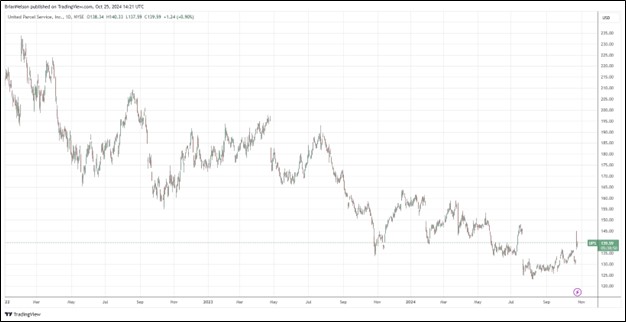

Image: UPS’ shares have been under pressure the past couple years.

By Brian Nelson, CFA

UPS (UPS) reported better than expected results October 24 with both revenue and non-GAAP earnings per share coming in higher than the consensus forecast. Consolidated revenue of $22.2 billion in the quarter reflected a 5.6% increase from the same period last year. Consolidated operating profit of $2.0 billion was up 47.8% compared to the third quarter of last year, while the measure advanced 22.8% on a non-GAAP adjusted basis. Diluted earnings per share was $1.80 for the quarter, while non-GAAP adjusted diluted earnings per share came in at $1.76, a 12.1% increase from the same period a year ago and above the consensus forecast of $1.62.

Management had the following to say about the quarter in the press release:

I want to thank all UPSers for their hard work and efforts. After a challenging 18-month period, our company returned to revenue and profit growth. Peak season is nearly upon us, and we are ready to deliver another successful holiday season and continue the progress we demonstrated in the third quarter.

In its U.S. Domestic segment, revenue increased 5.8% thanks to a 6.5% increase in average daily volume. On a non-GAAP adjusted basis, segment operating profit came in at $974 million, up materially from $665 million it posted in the same quarter last year. Revenue increased 3.4% in its International segment thanks in part to a 2.5% increase in revenue per piece, while non-GAAP adjusted segment operating profit came in at $792 million, up from $675 million in the year-ago period. Revenue increased 8% in its Supply Chain Solutions segment due in part to strength in air and ocean forwarding, while non-GAAP adjusted segment operating profit fell to $217 million from $275 million in the same period last year.

For the first nine months of the year, UPS hauled in $6.8 billion in operating cash flow and generated free cash flow of $4 billion. For full year 2024, UPS is targeting consolidated revenue of approximately $91.1 billion (was $93 billion), while it now expects its consolidated non-GAAP adjusted operating margin to be roughly 9.6% (was 9.4%). For the year, capital expenditures are targeted at $4 billion, while dividend payments are expected to be around $5.4 billion. Shares yield 4.7% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.