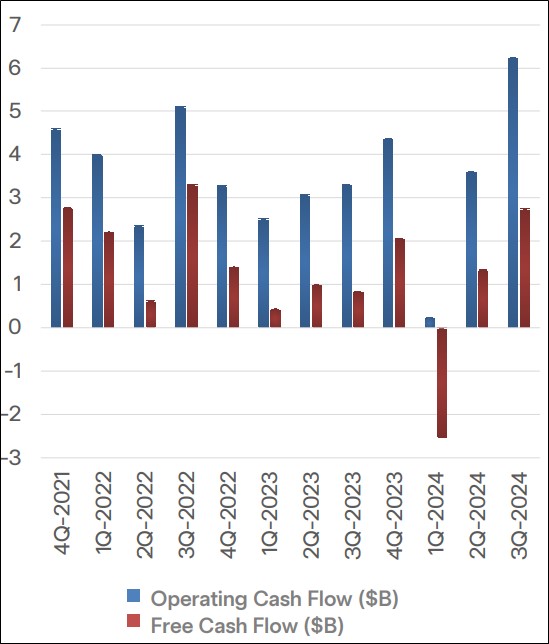

Image: Tesla has returned to a free cash flow rich entity.

By Brian Nelson, CFA

Tesla (TSLA) reported solid third quarter earnings on October 23. Total revenues increased 8%, while gross profit increased 20% in the quarter, as gross margins expanded nearly 200 basis points. Income from operations was up 54% thanks to more than a 320 basis-point improvement in its operating margin. Adjusted EBITDA advanced 24% in the quarter on a year-over-year basis thanks to a 240 basis-point improvement in its EBITDA margin. Non-GAAP net income increased 8% year-over-year, while non-GAAP diluted earnings per share increased 9% year-over-year.

Tesla’s total production was 469,796 in the quarter, up 9%, while total deliveries increased 6%, both on a year-over-year basis. Management noted that its cost of goods sold (COGS) per vehicle came down to its lowest level ever at ~$35,100, something that was reflected in the company’s improved profit margins in the period. Tesla noted that “preparations are underway for (its) offering of new vehicles – including more affordable models – which (it) will begin launching in the first half of 2025…The Cybertruck became the third best-selling EV in the third quarter in the U.S. (behind the Model Y and Model 3).”

Management had the following to say about current conditions:

Despite sustained macroeconomic headwinds and others pulling back on EV investments, we remain focused on expanding our vehicle and energy product lineup, reducing costs and making critical investments in AI projects and production capacity. We believe these efforts will allow us to capitalize on the ongoing transition in the transportation and energy sectors.

Net cash provided by operating activities was $6.3 billion in the quarter, while capital spending came in at $3.5 billion, resulting in free cash flow of $2.7 billion, which more than tripled on a year-over-year basis. The company experienced a $2.9 billion increase in its cash and investments in the third quarter, to $33.6 billion, versus short- and long-term debt of $4.4 billion. Management’s outlook was well-received:

Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and we believe the next one will be initiated by advances in autonomy and introduction of new products, including those built on our next generation vehicle platform. Despite ongoing macroeconomic conditions, we expect to achieve slight growth in vehicle deliveries in 2024. Energy storage deployments are expected to more than double year-over-year in 2024.

All in all, Tesla reported solid third quarter results that showed a business that is getting back on track. Not only did production and deliveries increase nicely on a year-over-year basis, but the firm’s margin improvement is a sight to see and comes in the wake of lowered vehicle selling prices. Tesla also showcased its cash generation capacity in the quarter, with free cash flow more than tripling. We like Tesla’s net-cash-rich balance sheet, its free cash flow generation, and its ability to drive growth, but we fall short of including shares in any newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.