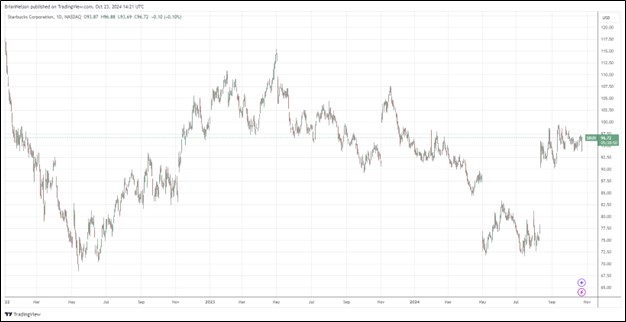

Image: Starbucks’ shares have been volatile the past couple years.

By Brian Nelson, CFA

Starbucks (SBUX) is in the midst of transition, and new CEO Brian Niccol will have his hands full getting the company back on track. On October 22, Starbucks announced preliminary results for its fiscal fourth quarter, and the outlook wasn’t rosy. For the fourth quarter of fiscal 2024, Starbucks’ global comparable store sales fell 7%, while consolidated net revenues declined 3%, to $9.1 billion. GAAP earnings per share came in at $0.80, down 25% on a year-over-year basis. Non-GAAP earnings per share fell 24% in the quarter.

Here is a summary of its fiscal fourth quarter results:

The company’s results were primarily driven by softness in North America’s revenues in the quarter, specifically a 6% decline in U.S. comparable store sales, driven by a 10% decline in comparable transactions, partially offset by a 4% increase in average ticket. The accelerated investments in an expanded range of product offerings coupled with more frequent in-app promotions and integrated marketing to entice frequency across the customer base did not improve customer behaviors, specifically traffic across both Starbucks Rewards and non-SR customer segments, resulting in lower-than-expected performance. Additionally, China comparable store sales declined 14%, driven by an 8% decline in average ticket compounded by a 6% decline in comparable transactions, weighed down by intensified competition and a soft macro environment that impacted consumer spending.

For all of fiscal 2024, Starbucks’ global comparable store sales fell 2%, while consolidated revenue increased 1% on a reported and constant currency basis. GAAP earnings per share fell 8%, while non-GAAP earnings per share dropped 6% on a constant currency basis. Management spoke of a 1) “pronounced traffic decline, including a cautious consumer environment,” 2) its “targeted and accelerated investments (are) not improving customer behaviors,” and 3) “the macro and competitive environment in China (is) pressuring (its) results further.”

Starbucks suspended its guidance for the full year 2025, given new CEO Brian Niccol and “the current state of the business.” That said, the company increased its quarterly cash dividend to $0.61 per share from $0.57 per share, which equates to a 2.5% forward estimated dividend yield, pointing to optimism regarding the long term. We’re cautious on Starbucks’ shares, as even the executive team noted that a turnaround “will take time.” Our fair value estimate stands at $85 per share, below where shares are trading at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.