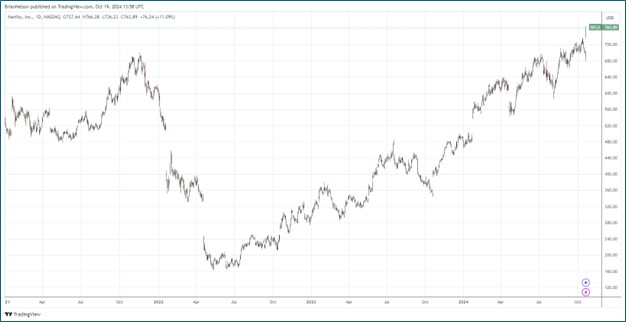

Image: Netflix’s shares are trading at all-time highs.

By Brian Nelson, CFA

On October 17, Netflix (NFLX) reported better than expected third quarter results with both revenue and GAAP earnings per share coming ahead of the consensus forecast. In the quarter revenue grew 15% on a year-over-year basis (21% on an F/X neutral basis), while the firm put up an operating margin of 29.6% versus 22.4% in the year-ago period. Global streaming paid memberships advanced 14.4%, to 282.72 million, as the firm recorded 5.07 million global streaming paid net additions on a sequential basis. Third quarter operating income advanced 52% year-over-year in the quarter.

Net cash provided by operating activities was $2.32 billion in the quarter, while the firm hauled in $2.2 billion in free cash flow, up from $1.9 billion in the year-ago period. For the full year 2024, Netflix anticipates free cash flow in the range of $6-$6.5 billion, up from its prior forecast of $6 billion. Looking to the fourth quarter of 2024, management expects 14.7% revenue growth (17% on an F/X neutral basis) on an operating margin of 21.6% (a 4.7 percentage point year-over-year improvement), and for net income to come in at $1.85 billion and for diluted earnings per share to reach $4.23, well above last year’s mark of $2.11 per share. For 2024, management is targeting revenue growth of 15%, at the high end of its 14%-15% target, and an operating margin of 27% versus 26% previously.

Management talked positively about 2025 in the press release:

We’re pleased that we’ve reaccelerated our growth and, as we head into 2025, we expect to deliver solid revenue and profit growth by both improving our core series and film offering while investing in new growth initiatives like ads and gaming. For 2025, based on F/X rates as of 9/30/24, we forecast revenue of $43B-$44B, which would represent growth of 11%-13% off of our 2024 revenue guidance of $38.9B. We expect revenue growth to be driven by a healthy increase in paid memberships and ARM. We’re targeting a 2025 operating margin of 28% (also based on F/X rates as of 9/30) vs. our forecast for 27% in 2024; after delivering outsized margin improvement in 2024, we want to balance near term margin growth with investing appropriately in our business. We still see plenty of room to increase our margins over the long term.

We liked Netflix’s revenue and operating income improvement in the third quarter, as well as its outlook for the fourth quarter of 2024 and 2025. Netflix is delivering with respect to content and customer engagement, and we like the fact that the firm continues to generate strong free cash flow. Netflix continues to build its advertising business, with ads membership up 35% on a sequential basis. Looking to the fourth quarter, Netflix has a nice slate of content, including Squid Game S2, the Jake Paul/Mike Tyson fight, and two NFL games on Christmas day, which Netflix expects to drive paid net additions higher in the quarter than in its most recently reported third quarter. The high end of our fair value estimate range for Netflix is $867 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.