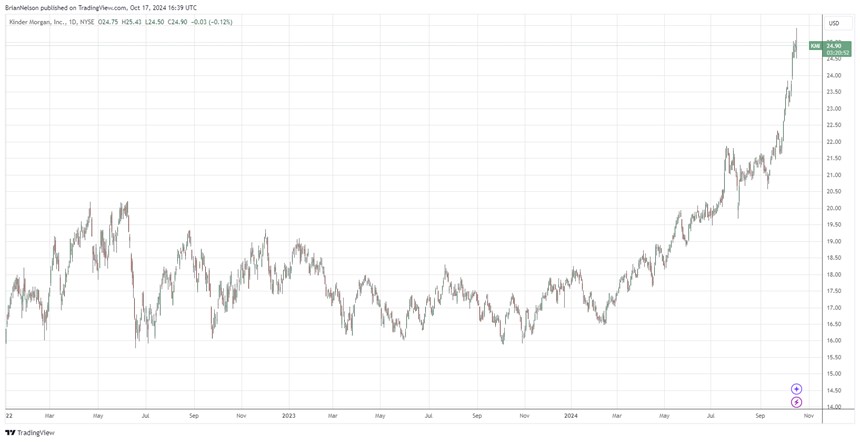

Image: Kinder Morgan’s shares have done quite well thanks to improved free cash flow performance.

By Brian Nelson, CFA

On October 16, pipeline giant Kinder Morgan (KMI) reported weaker than expected third quarter results, with both revenue and non-GAAP earnings per share coming in lower than what the Street was looking for. Adjusted EBITDA expanded 2% in the third quarter on a year-over-year basis, while net income attributable to KMI came in at $625 million, higher than the $532 million mark it posted in the year-ago quarter. Third quarter earnings per share was up 17% compared to the same period last year, but adjusted earnings per share of $0.25 and distributable cash flow of $0.49 per share were flat on a year-over-year basis.

Management had a lot to say about the quarterly results:

…we enjoyed another solid quarter of strong operational and financial performance. We continued to internally fund high-quality capital projects while generating cash flow from operations of $1.2 billion, and $0.6 billion in free cash flow (FCF) after capital expenditures. With substantial projected increases in natural gas demand both domestically and globally in the coming decades, we have many opportunities on the horizon…KMI’s balance sheet remains very strong, as we ended the quarter with a Net Debt-to-Adjusted EBITDA ratio of 4.1 times…Our project backlog at the end of the third quarter was $5.1 billion versus $5.2 billion in the second quarter of 2024. Holding our backlog nearly flat is notable given that we put $484 million of projects into service during the quarter.

Year-to-date Kinder Morgan’s free cash flow, as measured by cash flow from operations less all capital spending, totaled $2.27 billion, higher than the $1.92 billion it paid in cash dividends during the same time period. Years ago, Kinder Morgan’s capital spending and cash dividends paid were significantly higher than cash flow from operations, necessitating a dividend cut. Things are much different these days, as Kinder Morgan’s free cash flow covered cash dividends paid by $353 million during the first nine months of the year. Though the firm retains a large net debt position, Kinder Morgan’s dividend is much healthier than it was years ago. Shares yield 4.6% at the time of this writing.

—–

Tickerized for holdings in the AMLP.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.