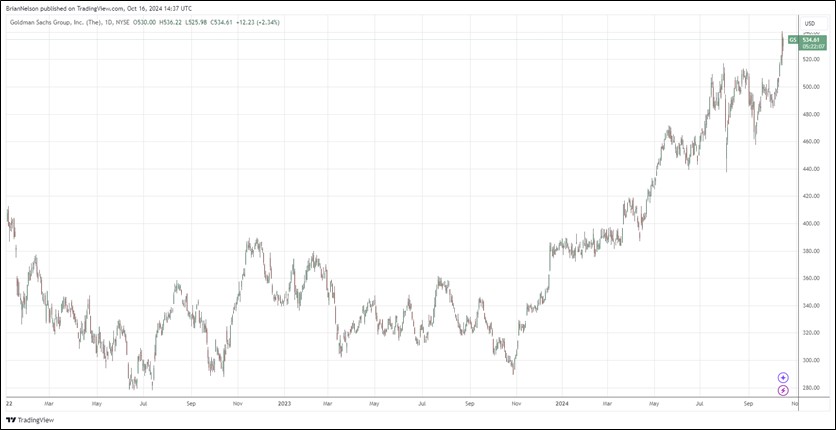

Image: Goldman Sachs’ shares have done well the past couple years.

By Brian Nelson, CFA

On October 15, Goldman Sachs (GS) reported better than expected third-quarter results with revenue and GAAP earnings per share topping the consensus forecast. Net revenue and net earnings in the quarter came in at $12.7 billion and $2.99 billion, respectively, while diluted earnings per common share was $8.40 for the third quarter of 2024, better than the consensus forecast of $6.92 per share.

Net revenues were up 7% year-over-year thanks to higher net revenues in Global Banking & Markets and Asset & Wealth Management, offset in part by lower net revenues in Platform Solutions, while diluted earnings per share was modestly lower on a year-over-year basis. Diluted earnings per share for the first nine months of 2024 was $28.64, which compares with $17.39 for the first nine months of 2023.

Quarterly highlights were plenty:

Global Banking & Markets generated quarterly net revenues of $8.55 billion, including strong performance in Equities and record quarterly net revenues in Fixed Income, Currency and Commodities (FICC) financing.

The firm ranked #1 in worldwide announced and completed mergers and acquisitions and common stock offerings for the year-to-date.

Asset & Wealth Management generated quarterly net revenues of $3.75 billion, including record quarterly Management and other fees.

Assets under supervision increased $169 billion during the quarter to a record $3.10 trillion.

Book value per common share increased by 1.8% during the quarter to $332.96.

Goldman Sachs continues to generate value for shareholders. Annualized return on average common shareholder equity [ROE] was 10.4% for the third quarter of 2024 and 12.0% for the first nine months of 2024. CEO David Soloman had the following to say about the quarter: “Our performance demonstrates the strength of our world-class franchise in an improving operating environment. We continue to lean into our strengths – exceptional talent, execution capabilities and risk management expertise – allowing us to effectively serve our clients against a complex backdrop and deliver for shareholders.” We liked Goldman’s revenue growth in the quarter, and the company continues to put up double-digit economic returns. Shares trade at 1.6x book value, so we’re not viewing them as cheap at this time. Shares yield 2.3%.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.