By Brian Nelson, CFA

Johnson & Johnson (JNJ) reported third-quarter results on October 15 that beat the consensus forecast for both revenue and non-GAAP earnings per share. The company posted adjusted operational sales growth of 5.4% thanks to 6.4% expansion in Innovative Medicine and 3.7% growth in MedTech, while adjusted earnings per share came in at $2.42 in the quarter, down 9% as acquired IPR&D impacted results.

Year-to-date free cash flow came in approximately $14 billion, up from $12 billion in the year ago period. J&J noted that it continues to advance its pipeline, including approvals for TREMFYA in ulcerative colitis and RYBREVANT + LAZCLUZE in non-small cell lung cancer.

Management commentary was upbeat in the quarter:

Johnson & Johnson’s strong results in the third quarter reflect the unique breadth of our business and commitment to delivering the next wave of healthcare innovation. During the quarter, we advanced our pipeline with regulatory approvals for TREMFYA and RYBREVANT, submitted an IDE for our general surgery robotic system, OTTAVA, and launched VELYS Spine and Shockwave E8 IVL Catheter, further strengthening our confidence in our near-and long-term growth targets.

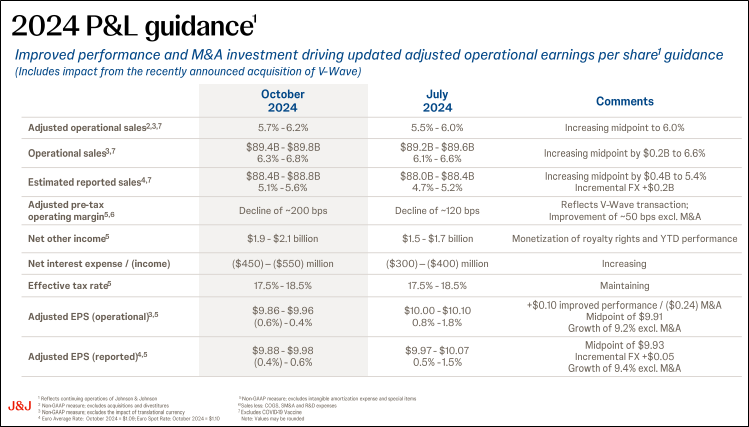

Image: Johnson & Johnson’s 2024 P&L guidance.

Looking to all of 2024, Johnson & Johnson expects the midpoint of adjusted operational sales growth of 6%, up from its prior expectation of 5.8%. At the midpoint, diluted adjusted operational earning per share expansion is targeted at $9.91 per share down from $10.05 per share due to a negative impact from its recent acquisition of V-Wave. Our fair value estimate stands at $165 per share, about in-line with where shares are currently trading. Shares yield ~3%.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.