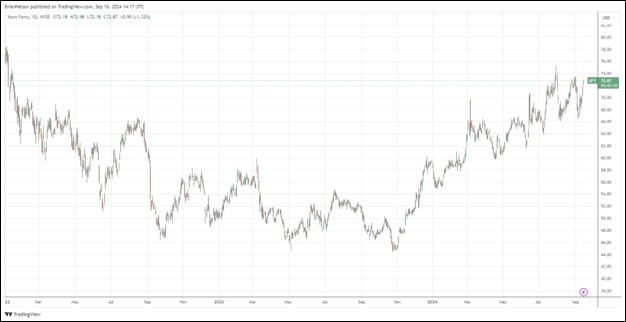

Image: Korn Ferry’s shares have bounced nicely since its bottom in late 2023.

By Brian Nelson, CFA

Korn Ferry (KFY) recently reported better than expected fiscal first quarter 2025 results with both revenue and non-GAAP earnings per share coming higher than the consensus estimate. Fee revenue fell 3%, but Executive Search fee revenue grew 2%, while fee revenue for Consulting and Digital was flat. Revenue in Professional Search and Recruitment Process Outsourcing (“RPO”) faced pressure. Adjusted diluted earnings per share for its first quarter of fiscal 2025 was $1.18.

Management was upbeat in its commentary in the press release:

I am pleased with our first quarter results, as we generated $675 million in fee revenue. Earnings and profitability increased year over year as we delivered $111 million of Adjusted EBITDA, at a 16.5% margin, which is our fifth consecutive quarter of profitability improvement.

Our sustained success stems from a balanced approach – from our colleagues and IP to our diversified strategy and broad offerings. As a result, our topline is more than 30 percent higher than before the pandemic, with even greater profitability. During the quarter, Consulting and Digital maintained their positive momentum, with improved growth in Executive Search and stable trends across Professional Search permanent placement and RPO. We are also confident about the future, as evidenced by our capital allocation, which not only included share buybacks but also more than a twofold increase in our quarterly dividend year over year. Moving forward, we will continue to transform the business to enable our clients to Be More Than.

In the quarter, the company’s operating income came in at $76.1 million, up from $56.8 million in the same period a year ago thanks in part to a 320 basis point improvement in its operating margin due in part to strong cost management. Adjusted EBITDA in the quarter came in at $111.2 million versus $95.7 million in last year’s quarter, as its adjusted EBITDA margin expanded 280 basis points. Net income attributable to Korn Ferry was $62.6 million, up from $46.6 million in the year-ago period.

Looking to the second quarter of fiscal 2025, Korn Ferry’s fee revenue is expected in the range of $655-$685 million, while adjusted diluted earnings per share is expected to be between $1.14-$1.26. Though Korn Ferry faced pressure in Professional Search and RPO during its fiscal first quarter, we liked the improvement in Executive Search fee revenue, as well as its margin expansion, which was material in the period. Our fair value estimate for Korn Ferry stands at $78 per share. Shares yield 2.1%.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.