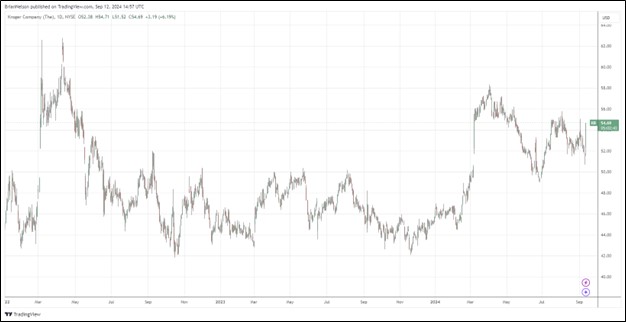

Image: Kroger’s shares have been choppy during the past couple years.

By Brian Nelson, CFA

On September 12, Kroger (KR) reported mixed second quarter results with revenue coming up short of the consensus forecast, but non-GAAP earnings per share exceeding what the Street was looking for. Total sales advanced 0.2% in the quarter helped by identical sales without fuel increasing 1.2%, which lapped a 1% increase in identical sales growth during the same quarter a year ago. Adjusted earnings per share in the quarter came in at $0.93, down modestly from the year-ago period.

Commentary in the press release was upbeat:

Kroger achieved solid results in the second quarter demonstrating the strength and resiliency of our model. We are growing households and increasing customer visits by offering a compelling combination of affordable prices and personalized promotions on great quality products, all through a unique seamless experience. We appreciate our associates for their focus on full, fresh and friendly, which elevates the customer experience. Our long-term model is to consistently invest to lower prices so more customers shop with us, which in turn fuels our alternative profit businesses and drives greater efficiencies. This flywheel enables Kroger to deliver exceptional value for customers and investing in our associates, and by doing so, we are well-positioned to generate attractive and sustainable returns for shareholders.

Looking to fiscal 2024, Kroger reaffirmed its guidance for adjusted FIFO operating profit in the range of $4.6-$4.8 billion, adjusted net earnings per diluted share in the range of $4.30-$4.50, and adjusted free cash flow of $2.5-$2.7 billion. It updated its identical sales growth without fuel forecast to 0.75%-1.75% for the year, which is up from the prior range of 0.25%-1.75%. Kroger continues to work toward closing its merger with Albertsons (ACI), the completion of which remains uncertain given criticism from the FTC. Our fair value estimate for Kroger stands at $55 per share.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.