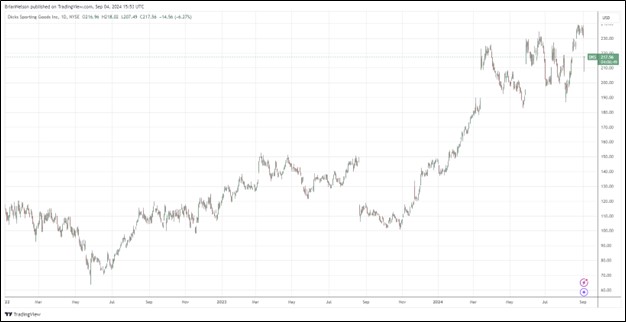

Image: Dick’s Sporting Goods has performed nicely since the beginning of 2022.

By Brian Nelson, CFA

Dick’s Sporting Goods (DKS) reported solid second quarter results September 4 with both revenue and non-GAAP earnings per share beating the consensus forecast. Net sales increased 7.8% in the quarter, while comparable sales growth totaled 4.5% for the period, lapping 2% from the year-ago period. Reported earnings per diluted share were $4.37 in the quarter, up 55% versus the same period a year ago. Management was upbeat in the press release:

Our strong second quarter demonstrated the continued success of our long-term strategies and how DICK’S is truly differentiated within the industry. We are very enthusiastic about the significant growth opportunities ahead of us, including House of Sport and the repositioning of our portfolio. The future of our business is very bright, and I’d like to thank all our teammates for their strong execution in Q2 and for their dedication to DICK’S Sporting Goods.

We delivered a very strong second quarter. Powered by our compelling omni-channel athlete experience, differentiated product assortment, best-in-class teammate experience and our ability to create deep engagement with the DICK’S brand, we are driving sustained top-line momentum and gaining market share. Our Q2 comps were driven by growth in average ticket and transactions, and with growth in sales, gross margin expansion and SG&A leverage, we delivered EBT margin of nearly 14%. Because of our strong Q2 performance and the confidence we have in our business, we are again raising our full year outlook.

Dick’s Sporting Goods ended the quarter with $1.7 billion in cash and $1.5 billion in total debt. Net inventories were up 11% on a year-over-year basis. For the 26-week period ended August 3, 2024, the company returned to shareholders $164 million in share repurchases and $183 million in dividends paid. Cash flow from operations during the 26-week period to start the year was $626.1 million, down from $693.5 million, while capital spending advanced to $372.1 million from $693.5 million in the same period a year ago. Free cash flow for the first six months of the year was $254 million.

Looking to all of 2024, Dick’s Sporting Goods’ earnings per share is targeted in the range of $13.55-$13.90, up from $13.35-$13.75 per share previously, while net sales are expected in the range of $13.1-$13.2 billion (unchanged from last quarter), on comparable sales growth of 2.5%-3.5%, up from 2%-3% previously. We like Dick’s Sporting Goods’ quarter, and we’re fans of its raised outlook. The firm remains a holding in the portfolio of the Dividend Growth Newsletter.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.