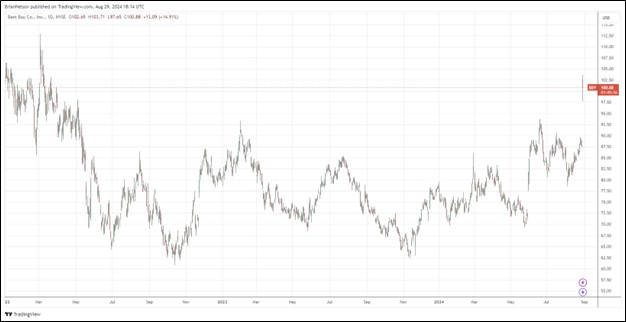

Image: Best Buy’s shares are bouncing back on an improved earnings outlook.

By Brian Nelson, CFA

On August 29, Best Buy (BBY) reported better than expected second quarter fiscal 2025 results, with revenue and non-GAAP earnings per share coming in higher than the consensus forecast. Though comparable store sales declined 2.3% in the quarter, management noted that it delivered better performance in its Domestic tablet and computing categories, which together posted comparable sales growth of 6% versus the same period a year ago. Non-GAAP earnings per share increased 10%, to $1.34, in the quarter.

Management spoke to industry stabilization in the press release:

As we look to the back half of the year, we expect our industry to continue to show increasing stabilization. Last quarter we said we believed we were likely trending towards the midpoint of our original comparable sales guidance and today we are updating our annual comparable sales guidance range to a decline of 1.5% to 3.0%. At the same time, we are raising our non-GAAP diluted EPS guidance range as we largely flow through the better-than-expected profitability of the first half of the year.

Looking to all of fiscal 2025, Best Buy’s revenue is now expected in the range of $41.3-$41.9 billion (was $41.3-$42.6 billion) on comparable sales declines of 3% to 1.5%, compared to prior guidance for comparable sales to decline 3% to flat. Management noted that weakness in appliances, home theater and gaming was the main driver for the decline. Though the revised revenue performance wasn’t great news, management increased its non-GAAP diluted earnings per share guidance for fiscal 2025 to the range of $6.10-$6.35, up from prior guidance of $5.75-$6.20. Shares yield 3.7% at the time of this writing.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.