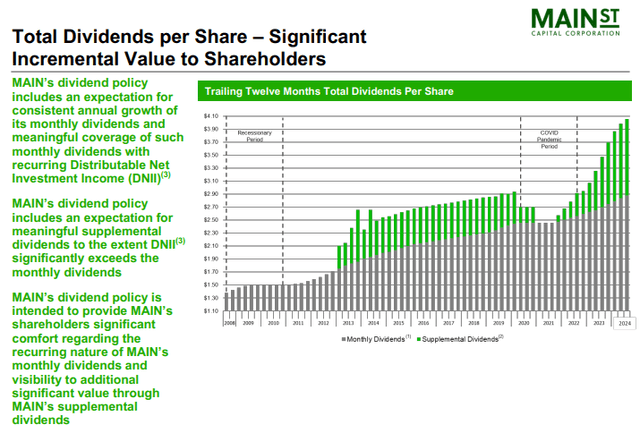

Image: Main Street has never lowered its monthly dividend, and it has paid supplemental dividends to bolster its yield. Image Source: Main Street

By Brian Nelson, CFA

Internally managed business development company Main Street (MAIN) recently reported second quarter results with net interest income and total investment income coming in better than expectations.

Net investment income came in at $87.3 million (or $1.01 per share) in the quarter, while distributable net investment income [DNII] was $92.3 million (or $1.07 per share) in the period. Total investment income was $132.2 million in the quarter, up 4% from the same period a year ago.

Return on equity was 16.1% on an annualized basis for the second quarter, while it was 18.5% for the trailing twelve-month period ended June 30, 2024, showcasing continued value creation. Net asset value was $29.80 per share at the end of the quarter, increasing 0.9% on a sequential basis. Shares of MAIN trade at roughly $50 each at the time of this writing, implying a price to book ratio of 1.68x.

Main Street declared regularly monthly dividends totaling $0.735 per share for the third quarter of 2024, representing a 6.5% increase from the third quarter of 2023. The business development company paid a supplemental dividend of $0.30 per share during its second quarter, bringing total dividends paid in the second quarter to $1.02, a 13.3% increase in total dividends from the second quarter of 2023.

Main Street is a principal investor in private debt and equity, with over $7.6 billion in capital under management. It primarily invests in the lower middle market [LMM], companies with revenue between $10-$150 million and EBITDA between $3-$20 million. It also provides private loans, debt instruments to middle market companies, and has an asset management advisory business. The company has an attractive 12.6% weighted-average cash coupon on its secured debt investments, as of June 30, 2024.

Image Source: Main Street

Main Street has never decreased its monthly dividend rate, with monthly dividends up more than 120% from $0.33 per share in the fourth quarter of 2007 to its declared dividends of $0.735 per share in the fourth quarter of this year. On a regular monthly dividend basis, shares of MAIN yield ~5.9%, but its supplemental dividends help to pad that annual rate. The company’s investment-grade credit ratings offer it the ability to take advantage of opportunities in the market, and we think shares are worth a look for the income investor.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.