By Brian Nelson, CFA

Starbucks (SBUX) recently reported mixed fiscal third quarter results with non-GAAP earnings per share coming in line with the consensus estimate, while revenue came up short. Global comparable store sales declined 3% in the 13-week period ended June 30, 2024, as comparable transactions declined 5%, while average ticket advanced 2%. Non-GAAP earnings per share of $0.93 fell 7% over the prior-year quarter (down 6% on a constant currency basis). Though Starbucks’ fiscal third quarter was mixed, we’re sticking with our $85 per-share fair value estimate for shares.

Starbucks experienced weakness across both its North America stores and its International stores. North America comparable store sales fell 2% as a 3% increase in average ticket failed to offset a 6% decline in comparable transactions. U.S. comparable store sales declined 2% as comparable transactions were once again weak. International comparable store sales fell 7% as both average ticket and comparable transactions fell 4% and 3%, respectively. China comparable store sales dropped 14% as both average ticket and comparable transactions dropped 7%.

Management spoke to a cautious consumer environment in the press release:

Our three-part action plan is beginning to work and driving operational improvements that we expect to improve financial performance. Our growing culture of focused innovation and relentless execution continues to enhance our capabilities, while helping return the business to sustainable growth. Our efficiency efforts, which are tracking ahead of expectations, partially offset investments associated with the cautious consumer environment. Collectively, our disciplined approach enables us to preserve both balance sheet strength and flexibility, positioning us to successfully navigate through the current macroeconomic environment.

ESG Matters

Starbucks produces a lengthy Global Impact Report. The company offers a very competitive benefits and compensation package in the retail industry. The average hourly pay at Starbucks during fiscal 2023 was $17.42 with 100% of its hourly employees earning above the minimum wage. Starbucks estimates that “factoring in the value of Starbucks benefits, that number can rise up to $10 for a total compensation, with benefits, of approximately $27/hour.

Starbucks is also focused on diversity:

In the U.S., (its) goal is to achieve racial and ethnic diversity of at least 30 percent at all corporate levels and at least 40 percent at all retail and manufacturing roles by 2025. (It) also aim(s) to achieve at least 50 percent women working across all corporate levels, 55 percent women working across all retail roles and 30 percent women working in manufacturing roles (Global Impact Report).

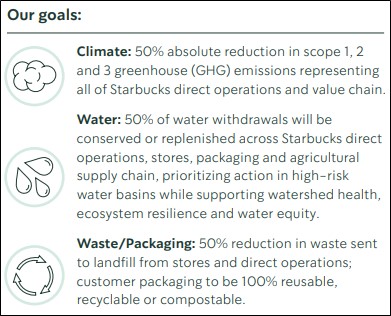

Image Source: Starbucks’ Global Impact Report

As it relates to the climate, management is targeting a 50% absolute reduction in scope 1, 2, and 3 greenhouse (GHG) emissions. With respect to water, its target includes 50% of water withdrawals to be conserved or replenished across its Starbucks direct operations, stores and agricultural supply chain. With respect to waste, Starbucks’ goal is a 50% reduction in waste sent to landfills and for consumer packaging to be 100% reusable, recyclable or compostable (Global Impact Report).

Concluding Thoughts

Starbucks’ fiscal third quarter results weren’t great. Consolidated revenue fell 1%, comparable store sales dropped, while the firm’s non-GAAP earnings per share faced additional pressures. During the fiscal third quarter, Starbucks opened 526 net new stores, ending the period with 39,477 stores — broken down into 52% company-operated and 48% licensed. Stores in the U.S. and China made up 61% of its global portfolio. Starbucks is getting squeezed by a cautious consumer and higher labor costs, and while we like the company, we’re just not interested in shares at this time.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.