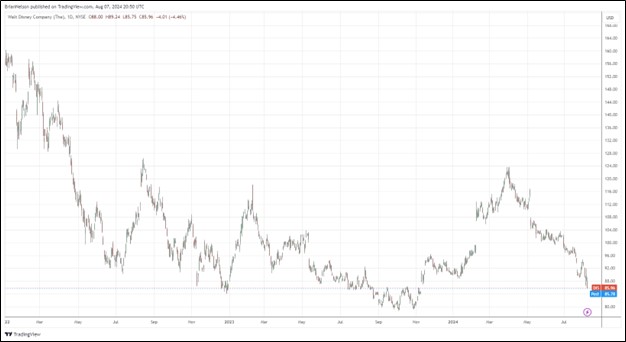

Image: Disney’s shares are under pressure despite marked improvement in earnings.

By Brian Nelson, CFA

On August 7, The Walt Disney Company (DIS) reported better than expected fiscal third quarter results with both revenue and non-GAAP earnings per share exceeding the consensus forecasts. Revenue advanced to $23.2 billion from $22.3 billion in the same quarter last year, while adjusted diluted earnings per share increased to $1.39 from $1.03 in the prior-year quarter. Revenue increased 4% in its Entertainment division, 5% in its Sports segment and 2% in its Experiences division. Segment operating income surged in its Entertainment division, while segment operating income faced pressure at Sports and Experiences.

Management had the following to say about the quarter:

Our performance in Q3 demonstrates the progress we’ve made against our four strategic priorities across our creative studios, streaming, sports, and Experiences businesses. This was a strong quarter for Disney, driven by excellent results in our Entertainment segment both at the box office and in DTC, as we achieved profitability across our combined streaming businesses for the first time and a quarter ahead of our previous guidance. Despite softer third quarter performance in our Experiences segment, adjusted EPS for the company was up 35%, and with our complementary and balanced portfolio of businesses, we are confident in our ability to continue driving earnings growth through our collection of unique and powerful assets.

Disney noted that within its Experiences division, “segment revenue growth was impacted by moderation of consumer demand towards the end of Q3 that exceeded (its) previous expectations.” Though the pace of consumer demand at Disney theme parks remains a big question during the current fiscal fourth quarter, management’s new full year adjusted earnings per share growth target is now 30%, which reveals a company that is making progress from its troubles a couple years ago. We value shares of Disney just shy of $100 each.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.