Image Source: Phillips 66 Investor Update

By Brian Nelson, CFA

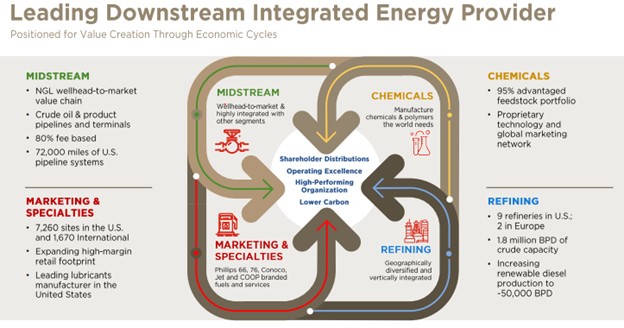

Phillips 66 (PSX) reported strong second quarter results July 30, with the firm generating second-quarter earnings of $1.0 billion or $2.38 per share. Adjusted earnings were $984 million or $2.31 per share. The company experienced record midstream NGL pipeline and fractional volumes and noted that synergy capture is driving lower costs. The company recorded strong refining operations with 98% crude utilization and 86% clean product yield.

Management commented on the strong quarter:

We are systematically executing on our strategic priorities, which is reflected in our second-quarter results. Refining crude utilization was our highest in five years and we lowered our costs by nearly a dollar per barrel, reflecting the success of our business transformation efforts. In Midstream, strong results reflect record NGL volumes and increased synergy capture. We continue to increase shareholder value through strong operating performance, disciplined capital allocation and asset portfolio optimization.

Phillips 66 generated strong cash flow from operations of $2.1 billion in the quarter, while capital spending was $367 million, good for free cash flow generation of $1.73 billion in the quarter, well in excess of its cash dividends paid of $485 million. Total debt was $19.96 billion at the end of the quarter, while its cash balance stood at $2.44 billion. Its net debt to capital ratio was 36%. During the quarter, management returned $1.3 billion to shareholders through dividends and buybacks.

We like Phillips 66’s investment prospects. The company recently raised its mid-cycle adjusted EBITDA target to $14 billion by 2025. It has a strong investment-grade credit rating of A3/BBB+, with a net debt-to-capital ratio target between 25%-30%. Maintaining capital discipline is par for the course for Phillips 66, as it has generated 12% average ROCE since 2012. The company targets returning more than 50% of operating cash to shareholders, too. Its shares yield 3.3% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.