Image: Taiwan Semiconductor reported better-than-expected second quarter results.

By Brian Nelson, CFA

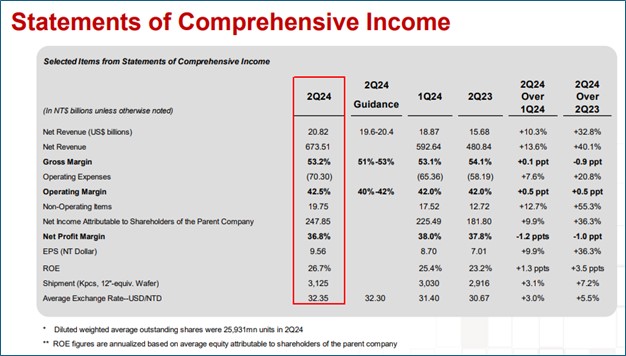

Taiwan Semiconductor (TSM) reported strong second quarter results on July 18. On a year-over-year basis, second-quarter revenue advanced more than 40%, while net income and diluted earnings per share increased more than 36%. Taiwan Semiconductor is experiencing strong momentum behind its operations as second-quarter revenue and net income showed a 13.6% and 9.9% sequential increase, respectively. Its revenue growth in the quarter was also better than guidance.

The company’s gross margin, operating margin, and net profit margin were 53.2%, 42.5%, and 36.8% in the quarter, respectively. Its gross margin and operating margin came in ahead of guidance. During the second quarter, shipments of 3-nanometer accounted for 15% of total wafer revenue, 5-nanometer accounted for 35%, while 7-nanometer accounted for 17%. High performance computing [HPC] accounted for more than half of revenue in the quarter, while smartphone revenue accounted for roughly one third.

Free cash flow swung into positive territory to the tune of NT$171.99 billion in the quarter versus negative free cash flow of NT$83.28 billion in the same period a year ago. The company ended the quarter with NT$2,048.64 billion in cash and marketable securities versus long-term interest-bearing debts of NT$974.34 billion.

Looking to the third quarter, management expects revenue to be in the range of $22.4-$23.2 billion, up 32% year-over-year at the midpoint. Gross margin is targeted in the range of 53.5%-55.5%, while operating margin is targeted in the range of 42.5%-44.5%. Taiwan Semiconductor’s business continues to be “supported by strong smartphone and AI-related demand for (its) leading edge process technologies.” For all of 2024, it forecasts “the overall semiconductor market excluding memory to increase by about 10%, which is unchanged from (its) forecast three months ago.” Management commentary on the conference call was very positive:

Over the past three months, we have observed strong AI and high-end smartphone related demand from our customers, as compared to three months ago, leading to increasing overall capacity utilization rate for our leading-edge 3-nanometer and 5-nanometer process technologies in the second half of 2024. Thus, we continue to expect 2024 to be a strong growth year for TSMC. We are raising our full-year guidance and now expect our 2024 revenue to increase slightly above mid-20s percent in US dollar terms.

Though Taiwan Semiconductor is exposed to geopolitical uncertainty, perhaps exacerbated by former President Donald Trump’s latest comments about how Taiwan should pay the U.S. for national defense, the company’s outlook remains robust, in our view. Taiwan Semiconductor remains one of our favorite ideas in the ESG Newsletter portfolio.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for TSM, INTC, GFS

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.