Image Source: Constellation Brands

By Brian Nelson, CFA

On July 3, alcoholic beverages giant Constellation Brands (STZ) reported mixed first quarter fiscal 2025 results, where revenue came in a bit light relative to expectations, but non-GAAP earnings per share was better than the consensus forecast. Comparable net sales increased 6%, while comparable operating income jumped 12%. Comparable earnings per share advanced 17%, to $3.57. Shares yield ~1.6% at the time of this writing.

Constellation’s Beer Business experienced an 8% increase in net sales thanks to a 7.6% advance in shipment volumes. Strength was prevalent across its Modelo Especial, Pacifico, and Modelo Chelada brands. Constellation’s Beer Business continues to gain share, with its “dollar sales and volume growth outpace(ing) the total beer category by 7.8 and 8.6 percentage points in the quarter, respectively.” Modelo Especial was the top brand in the whole U.S. beer category in dollar sales. For fiscal 2025, management expects its Beer Business to grow net sales 7%-9% with operating income growth in the range of 10%-12%.

Its Wine and Spirits Business’ net sales fell 7% in the quarter as shipment volumes fell 5.1% due to “challenging market conditions.” For 2025, net sales growth in its Wine and Spirits Business is expected to be in the range of -1% to 1%, while operating income is expected to decline 9%-11%.

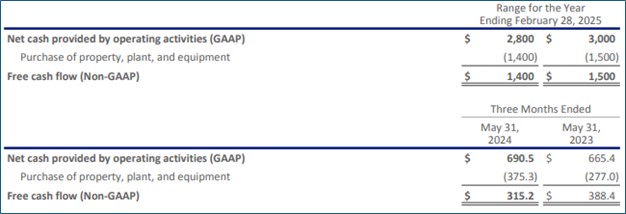

Looking to all of fiscal 2025 on a consolidated basis, net sales growth of 6%-7% is expected, while comparable operating income is targeted to expand 8%-10%. Operating cash flow is targeted in the range of $2.8-$3 billion, while free cash flow is expected to come in the range of $1.4-$1.5 billion. Comparable earnings per share is expected in the range of $13.50-$13.80, which compares to fiscal 2024’s mark of $12.38.

Constellation’s Beer Business continues to perform well, despite weakness across its Wine and Spirits operations, and we’re fans of the company’s free cash flow strength. The company ended its fiscal first quarter with $11.48 billion in total debt and $73.8 million in cash and cash equivalents, a sizable net debt position but one in which the firm can handle given free cash flow generation, which handily covers its dividend payments.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for STZ, BUD, SAM, DEO, HEINY, TAP

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.