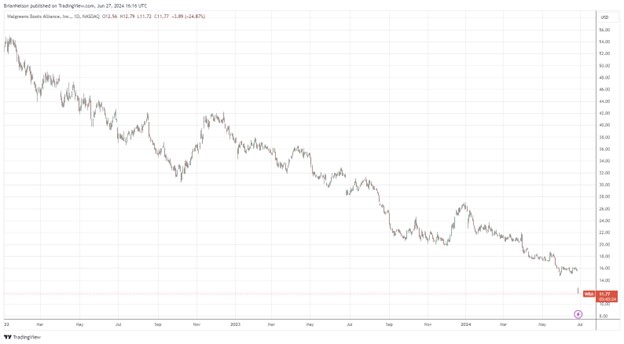

Image: Walgreens’ shares have been under constant pressure for some time now.

By Brian Nelson, CFA

On June 27, Walgreens Boots Alliance (WBA) reported mixed third quarter results for fiscal 2024. Though sales increased 2.6% from the year-ago period, adjusted operating income fell 36.3% on a constant-currency basis, reflecting in part “softer U.S. retail and pharmacy performance.” Adjusted net earnings told a similar story, falling 36.6%, to $0.63 per share in the quarter, missing the consensus estimate.

Management spoke of continued problems in its quarterly press release commentary:

We continue to face a difficult operating environment, including persistent pressures on the U.S. consumer and the impact of recent marketplace dynamics which have eroded pharmacy margins. Our results and outlook reflect these headwinds, despite solid performance in both our International and U.S. Healthcare segments. Informed by our strategic review, we are focused on improving our core business: retail pharmacy, which is central to the future of healthcare. We are addressing critical issues with urgency and working to unlock opportunities for growth. Many of these actions will take time, but I am confident that we have the right team and the right strategy to lead a business turnaround for the Walgreens that our customers and patients need.

Though net cash provided by operating activities and free cash flow improved in the fiscal third quarter, the better cash management was overshadowed by lowered guidance. The company lowered its fiscal 2024 adjusted earnings per share guidance to the range of $2.80-$2.95 “reflecting challenging pharmacy industry trends and a worse-than-expected U.S. consumer environment.” Consensus had been looking for $3.22 per share in adjusted earnings for the fiscal year. We’re not interested in Walgreens at all and think the worst may still be ahead for the company. Shares yield ~8.5% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.