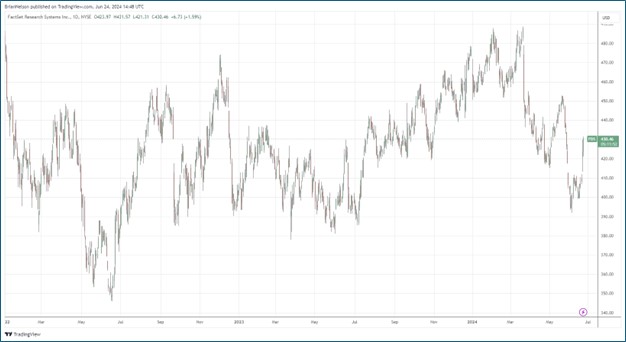

Image: FactSet’s shares have been choppy the past couple years.

By Brian Nelson, CFA

On June 21, FactSet Research (FDS) reported mixed third-quarter fiscal 2024 results that showed revenue increasing 4.3%, in-line with expectations, and adjusted diluted earnings per share of $4.37, up 15.3% from last year’s quarter and better than what the Street was looking for. The bottom line benefitted from higher revenues, margin expansion, as well as a reduced share count, offset in part by higher income taxes.

Organic revenue grew 4.5% on a year-over-year basis, while organic Annual Subscription Value (ASV), which “represents the forward-looking revenues for the next 12 months from all subscription services,” increased 5% on a year-over-year basis, to $2.22 billion. The company’s adjusted operating margin for the fiscal third quarter was 39.4%, up 340 basis points from the same period a year ago. Adjusted EBITDA advanced 16.9% in the third quarter of fiscal 2024.

Management’s comments noted some softness in its top line:

We continue to deliver value for our shareholders through increased EPS and adjusted operating margin, offsetting softness on the top line. We are updating our organic ASV plus professional services guidance for fiscal 2024 and now expect growth will be in the range of $85 million to $120 million, which represents annual growth of 4.8% at the midpoint, reduced from our previous guidance of $110 million to $150 million.

The company’s client count increased by 9 during the past three months, to 8,029, while user count increased by 1,662, to 208,140 thanks to strength in wealth. Annual ASV retention was greater than 95%, while when expressed as a percentage of clients, was 90%. Operating cash flow increased to 238.2 million from $218.6 million in last year’s quarter. Quarterly free cash flow was $216.9 million, up 12.6%. FactSet’s recent 6% dividend increase marked the 25th consecutive year the firm has raised its dividend on a stock split-adjusted basis. Shares yield ~1%.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for FDS, MCO, SPGI, MORN, VALU

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.