Image Source: Walmart

By Brian Nelson, CFA

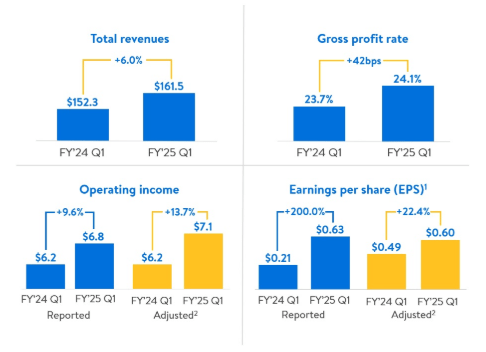

On May 16, Walmart (WMT) reported better than expected first quarter results for its fiscal 2025. Strength was evident across the board. Consolidated revenue increased 6% (5.8% in constant currency), while its consolidated gross margin increased 42 basis points. Walmart U.S. comp sales increased 3.8%, while total U.S. comps, excluding fuel, came in at 3.9% in the period.

The big box giant’s consolidated operating income increased 9.6% in the quarter, while adjusted operating income advanced 13.7%. Global e-commerce and its advertising business fared well, too, with sales increasing 21% and 24%, respectively, in the quarter. Adjusted earnings per share of $0.60 beat consensus, and management noted that inventory levels, which dropped in the quarter, remain healthy.

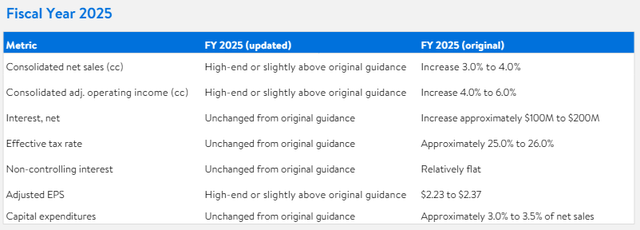

Looking to the company’s second quarter for fiscal 2025, Walmart expects net sales to increase 3.5%-4.5% and operating income to expand 3%-4.5% on a constant currency basis. Momentum has been building across Walmart’s operations in the current market environment where consumers are looking for convenience and savings, and management now believes sales and operating income to be “at the high-end or slightly above its previous guidance” for fiscal 2025.

Image Source: Walmart

Walmart is doing a fantastic job connecting with the consumer and delivering where it matters, both with respect to convenience and savings. Its e-commerce business contributed ~280 basis points to Walmart U.S.’s comp in the most recently reported quarter, for example. Traction with respect to store-fulfilled pickup and delivery are two main considerations driving Walmart’s comp resilience, while consumers continue to enjoy buying in bulk via Sam’s Club. We like Walmart’s positioning in the current retail environment as the firm continues to attract the cost-conscious consumer amid a step change in consumer goods inflation the past couple years.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.